Economic Growth and productivity

Module Overview

When you read the daily business news, it is dominated by reports of stock price fluctuations, the monthly unemployment and inflation rates, trade statistics, and speculation about whether the Federal Reserve will raise interest rates. But as important as these events are for job hunters or investors, they are only small ripples on the larger wave of economic growth. Year in and year out, advanced economies like the United States accumulate large quantities of capital equipment, push out the frontiers of technological knowledge, and become steadily more productive. Over the long run of decades and generations, living standards, as measured by output per capita or consumption per household, are primarily determined by the level of productivity and growth of a country.

In this module, we are going to examine the complicated process of economic growth. In doing so, we will not only come to understand more clearly the critical role that productivity plays in this process, but we will also gain some valuable insight into both how and why government policies play a critical role in the growth process.

Key Questions:

-

Define economic growth.

-

What are the four supply factors of growth?

-

What two other factors are important in economic growth?

-

Use PPF analysis to contrast Adam Smith’s golden age of growth versus Thomas Malthus’ doomsday.

-

Explain the basic underlying principle of the Neoclassical growth model and provide examples.

-

Why does capital deepening not lead to a proportional increase in output?

-

What happens to worker wages and the return on capital as a result of capital deepening?

-

Explain why capital deepening in the absence of technological change leads to economic stagnation.

-

Define, and provide examples of, technological change.

-

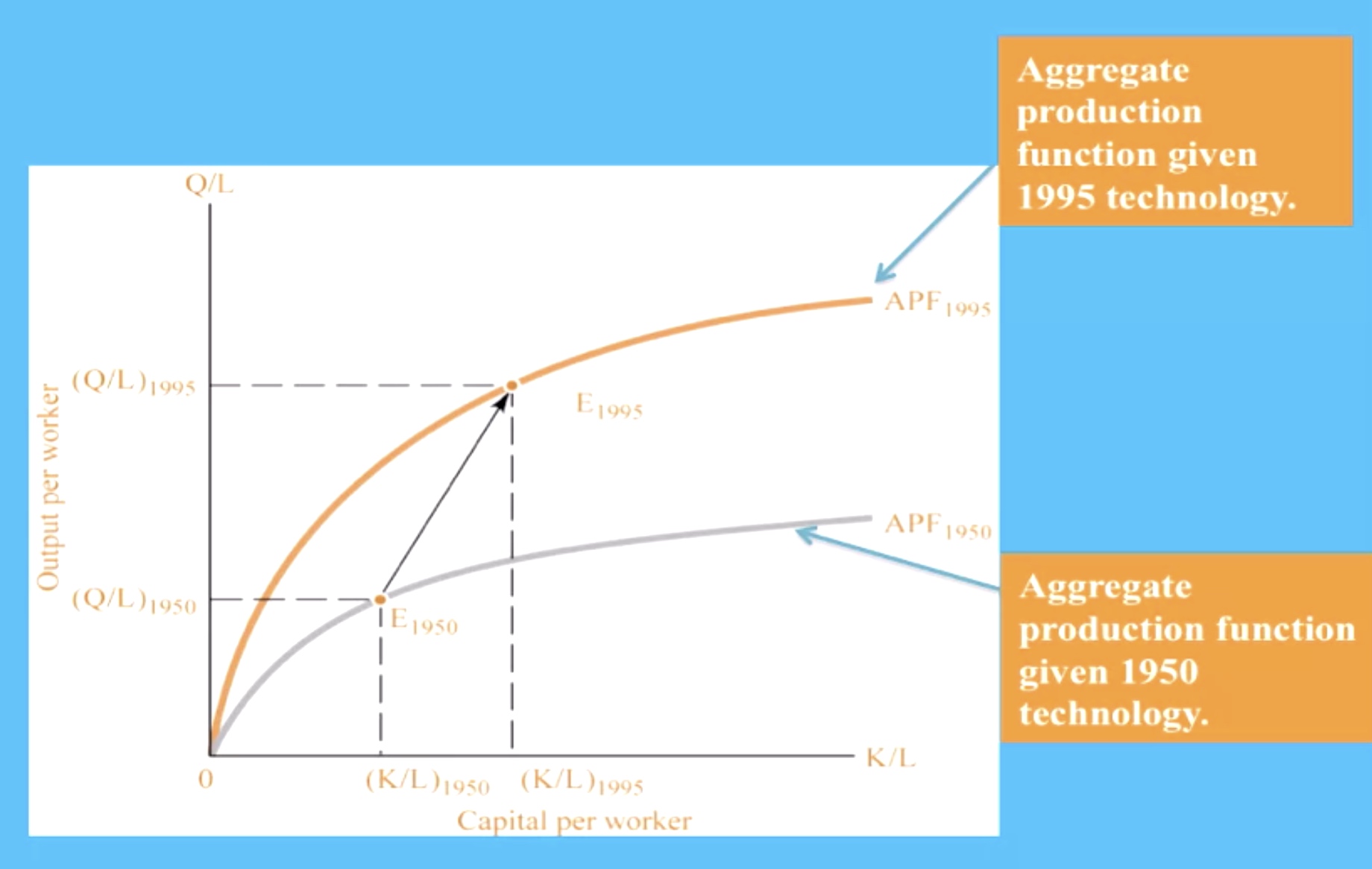

Use the concept of the aggregate production function to illustrate the differing roles that capital deepening and technological change play in economic growth.

-

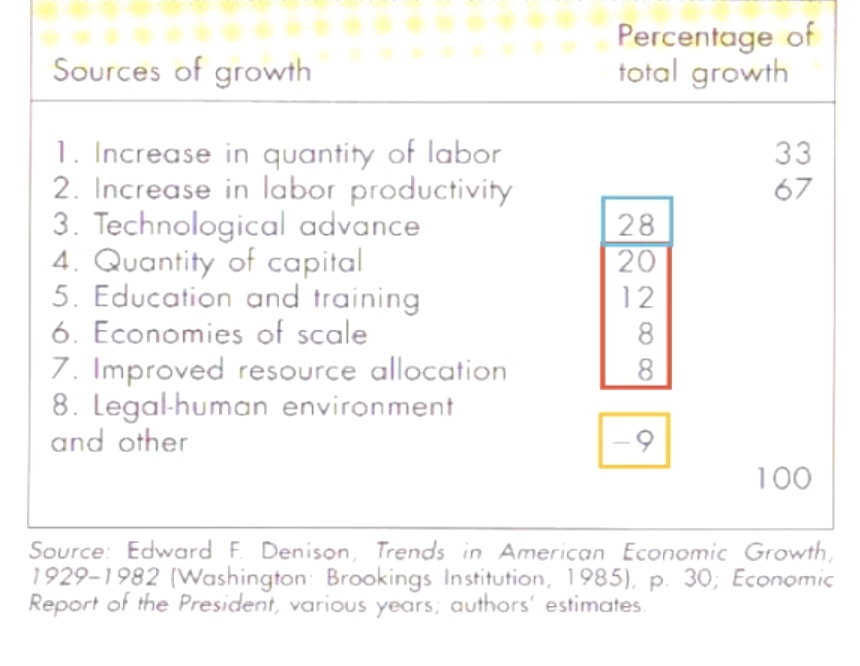

Which factors of growth have been the most instrumental in increasing labor productivity?

-

According to economist Edward Denison, what has been the most important source of economic growth in the US?

-

Explain the relationship between productivity and wages.

-

Is more growth always good?

-

How might the government use public policy to stimulate growth? Discuss both Demand-side and Supply-side options.

Four wheels

Growth of the potential GDP.

The Growth Models of Adam Smith and Thomas Malthus

The Neoclassical Growth Model

Budget Deficits and the Public Debt

This module examines the economic consequences of chronic budget deficits and the potential dangers of an upward spiraling government debt.

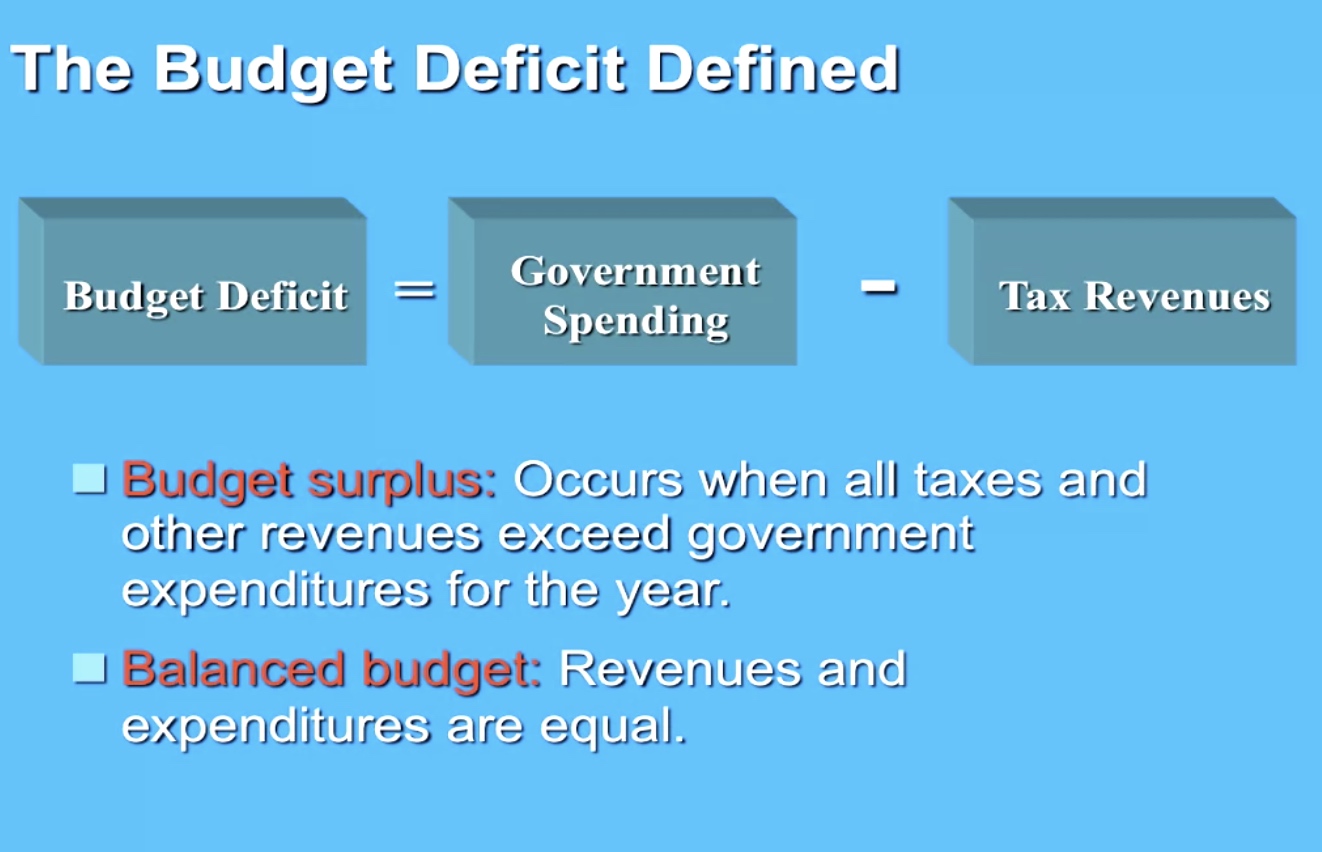

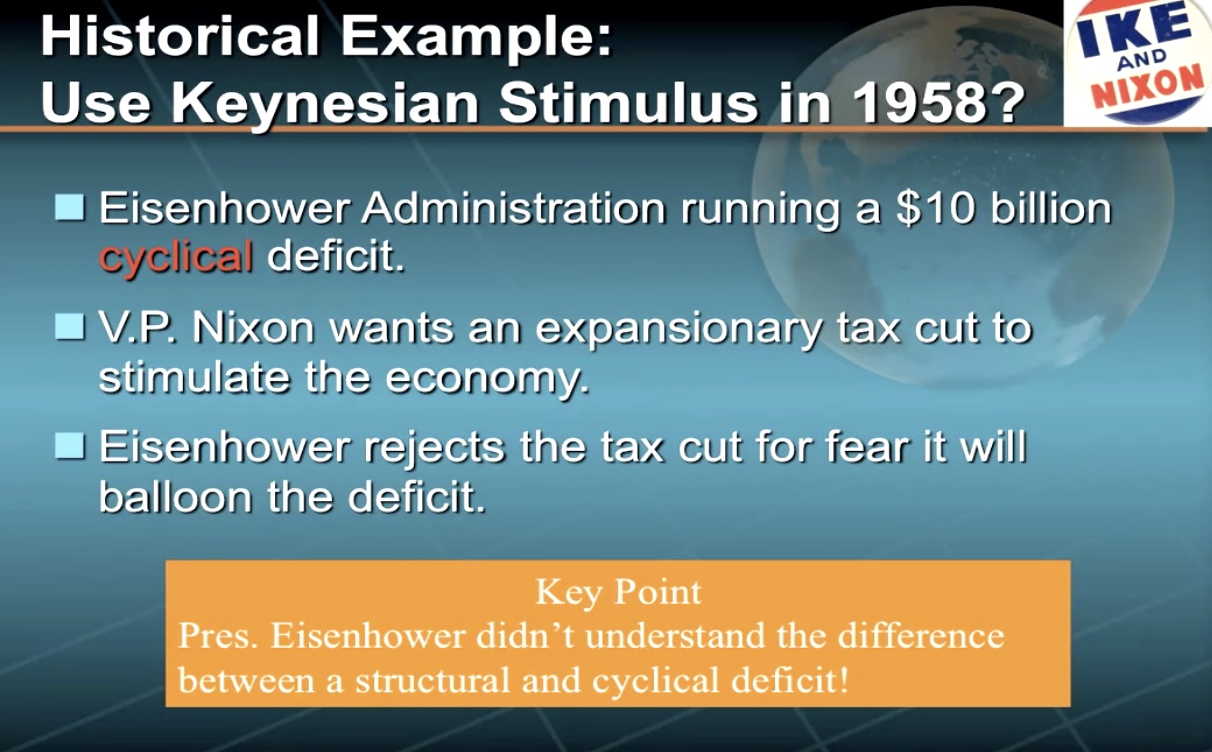

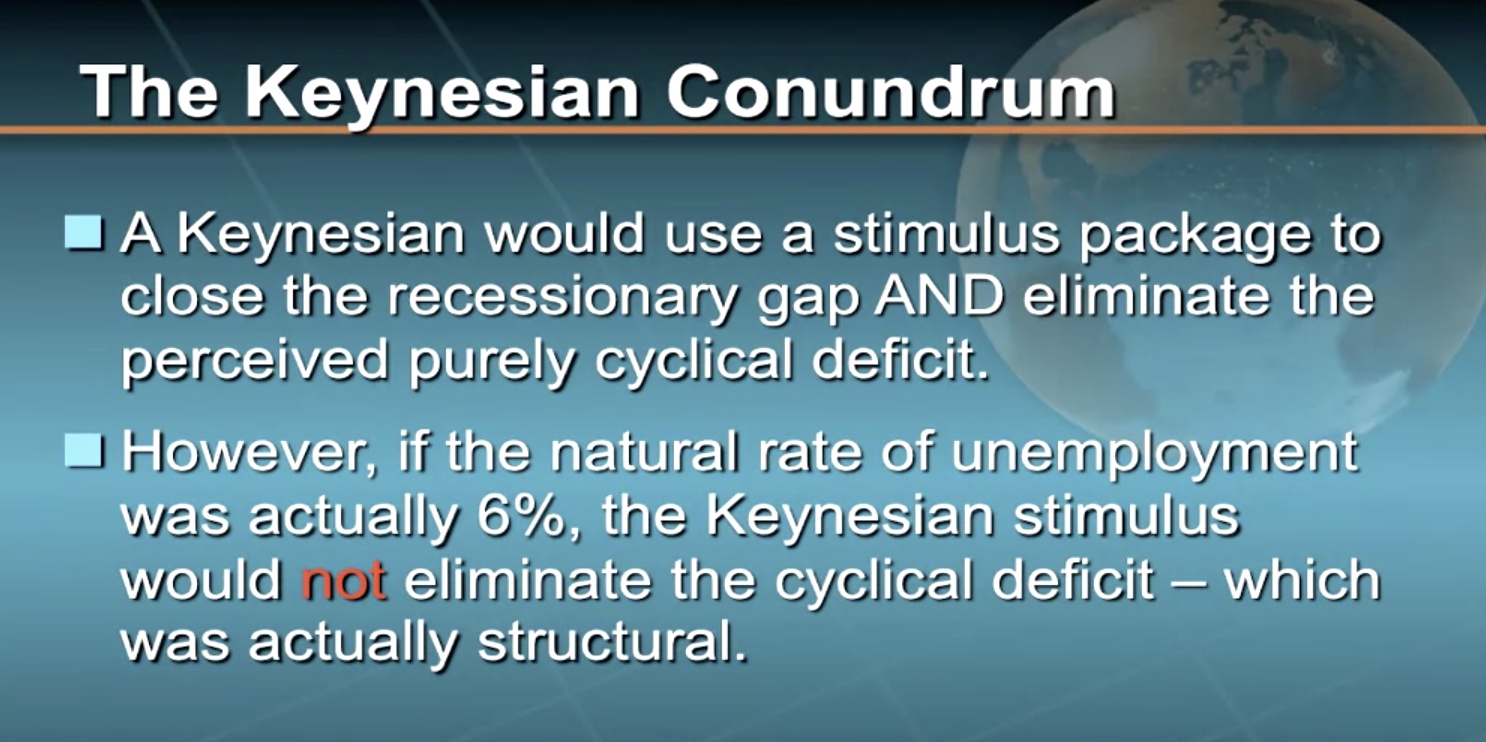

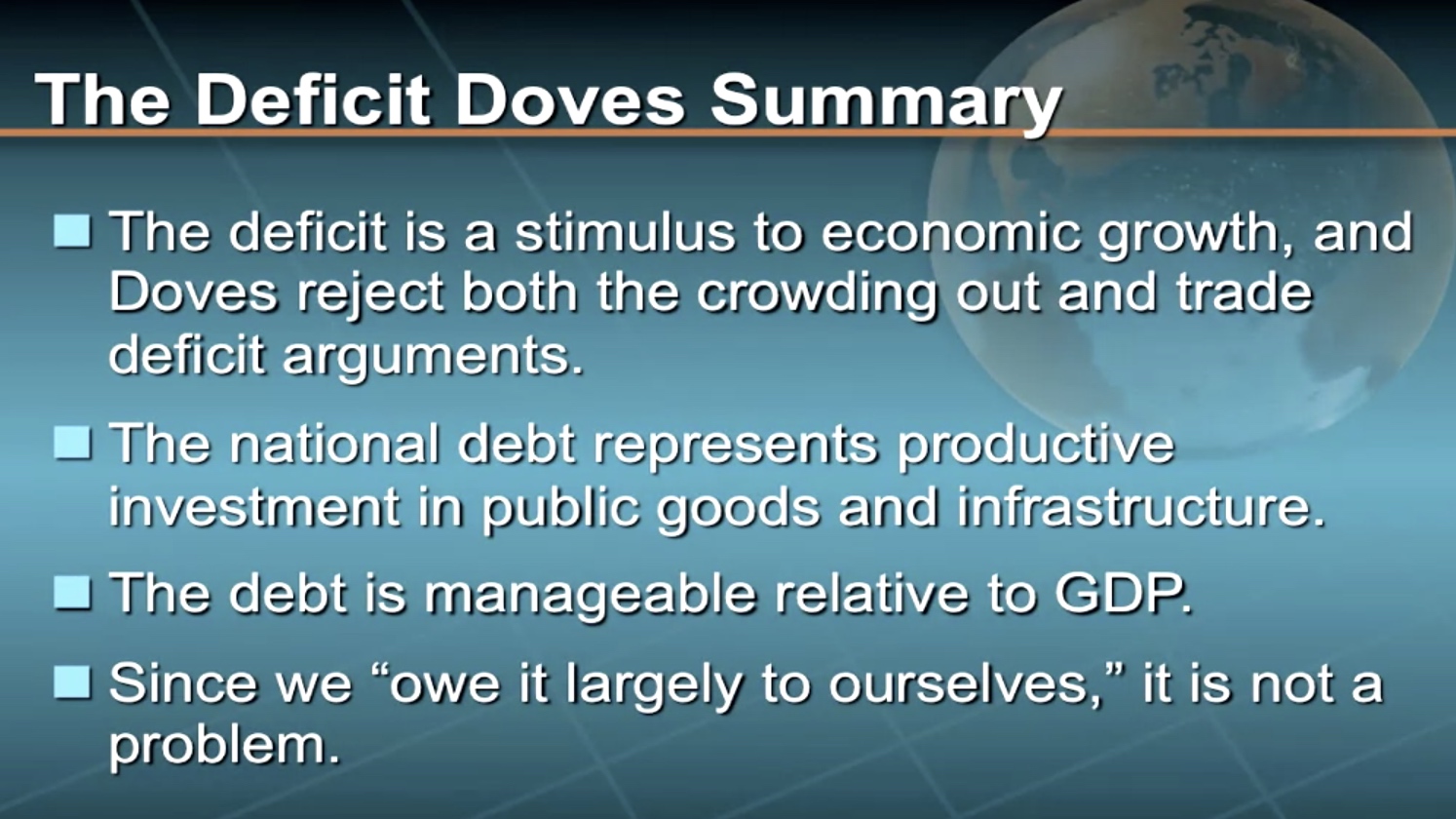

Historically, Classical economists have argued that such budget deficits are bad and should be avoided except in wartime. In contrast, Keynesians believe that, at least during recessions, budget deficits are a necessary byproduct of an expansionary fiscal policy. Nonetheless, both Classical and Keynesian economists agree that chronic budget deficits are undesirable. The important policy question is this: How big a danger are these chronic deficits and a collateral soaring national debt?

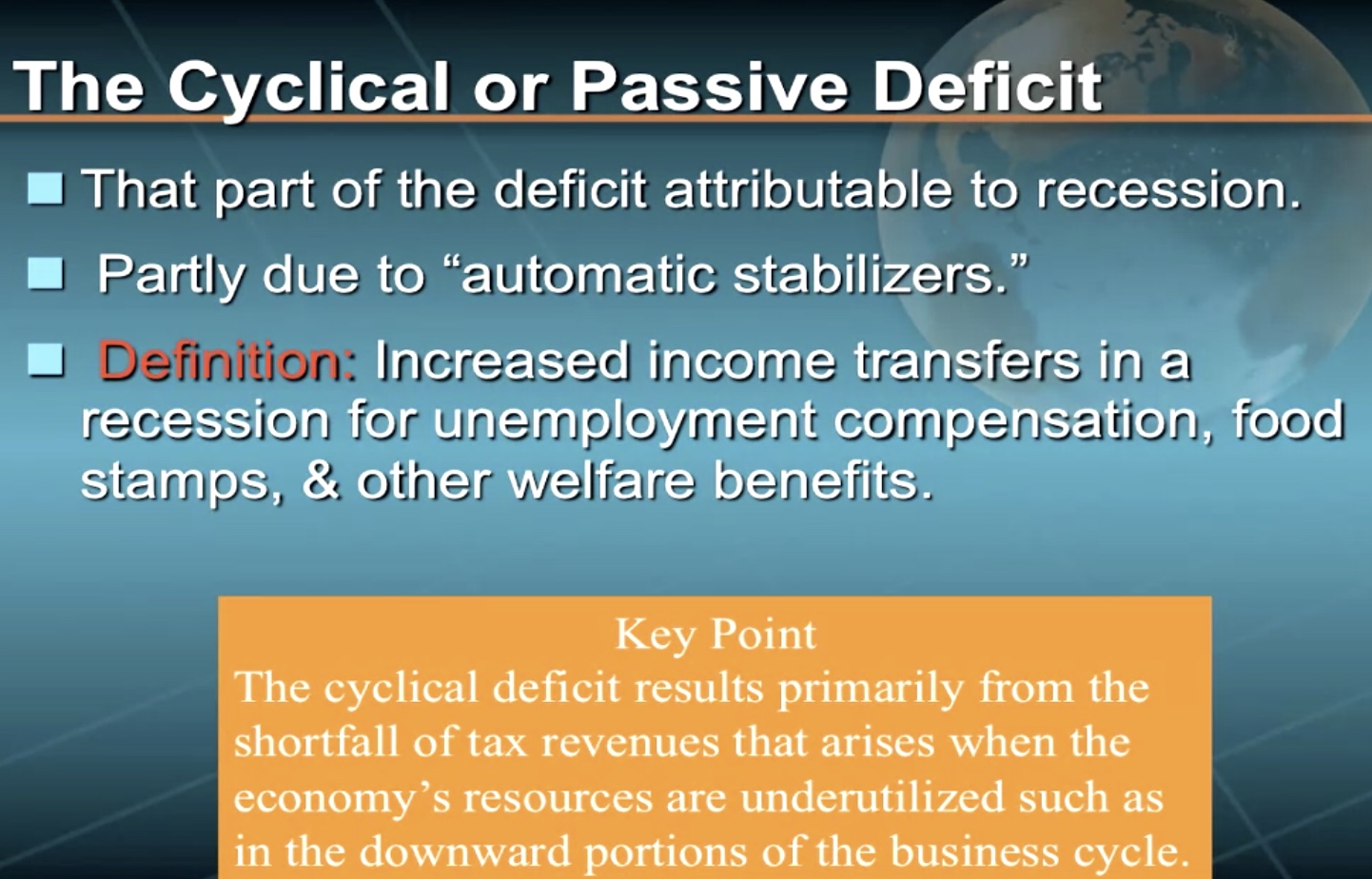

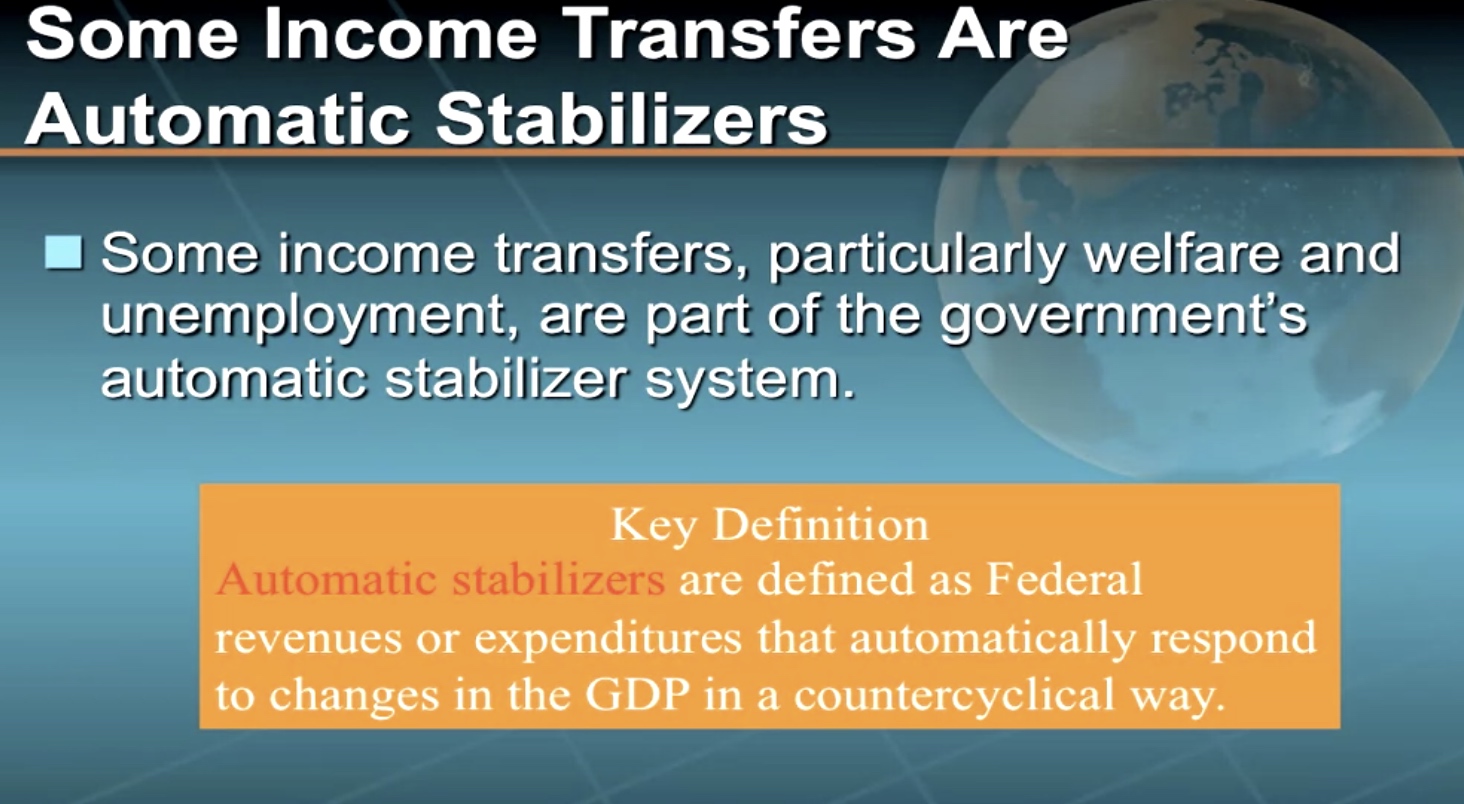

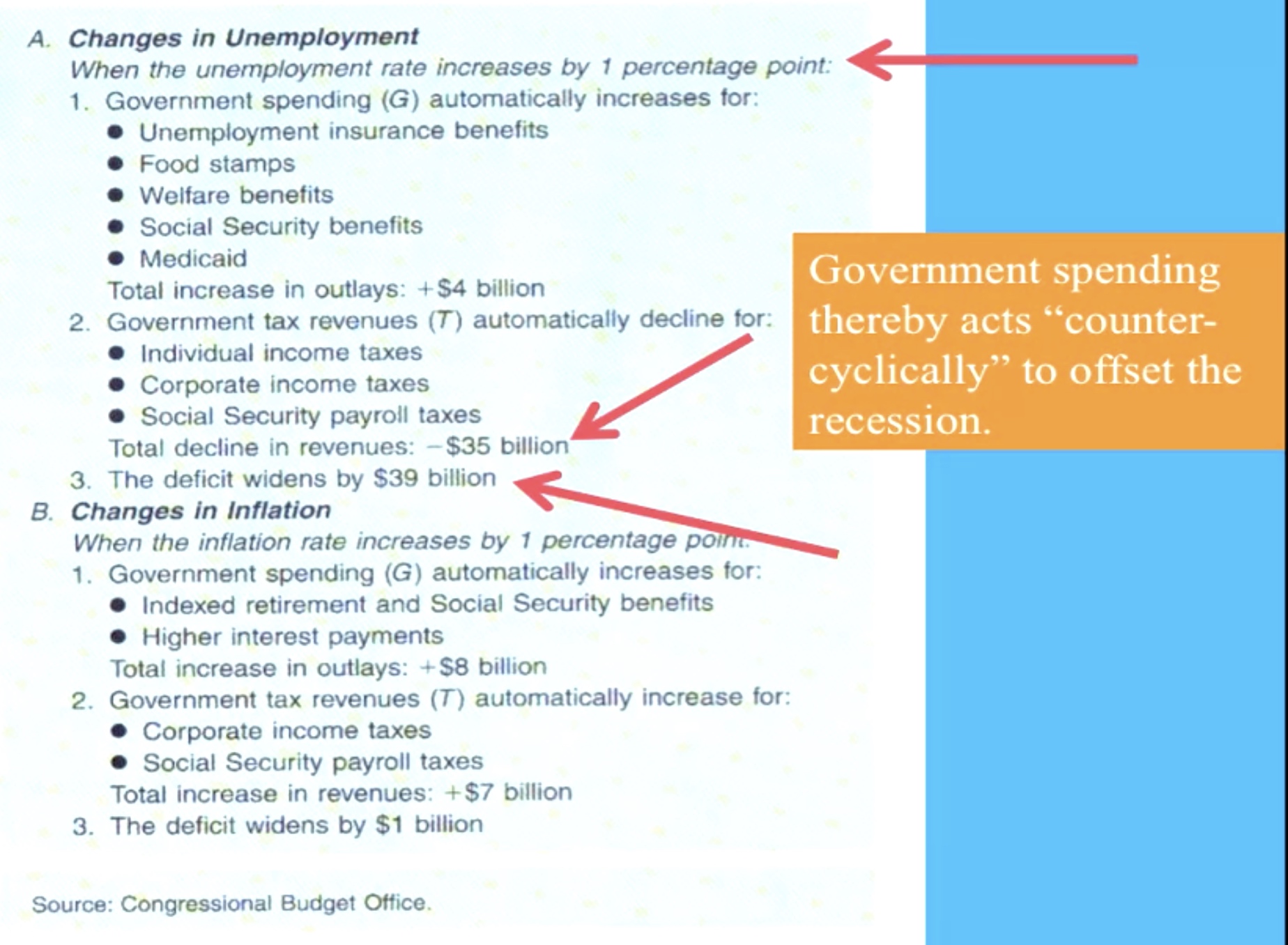

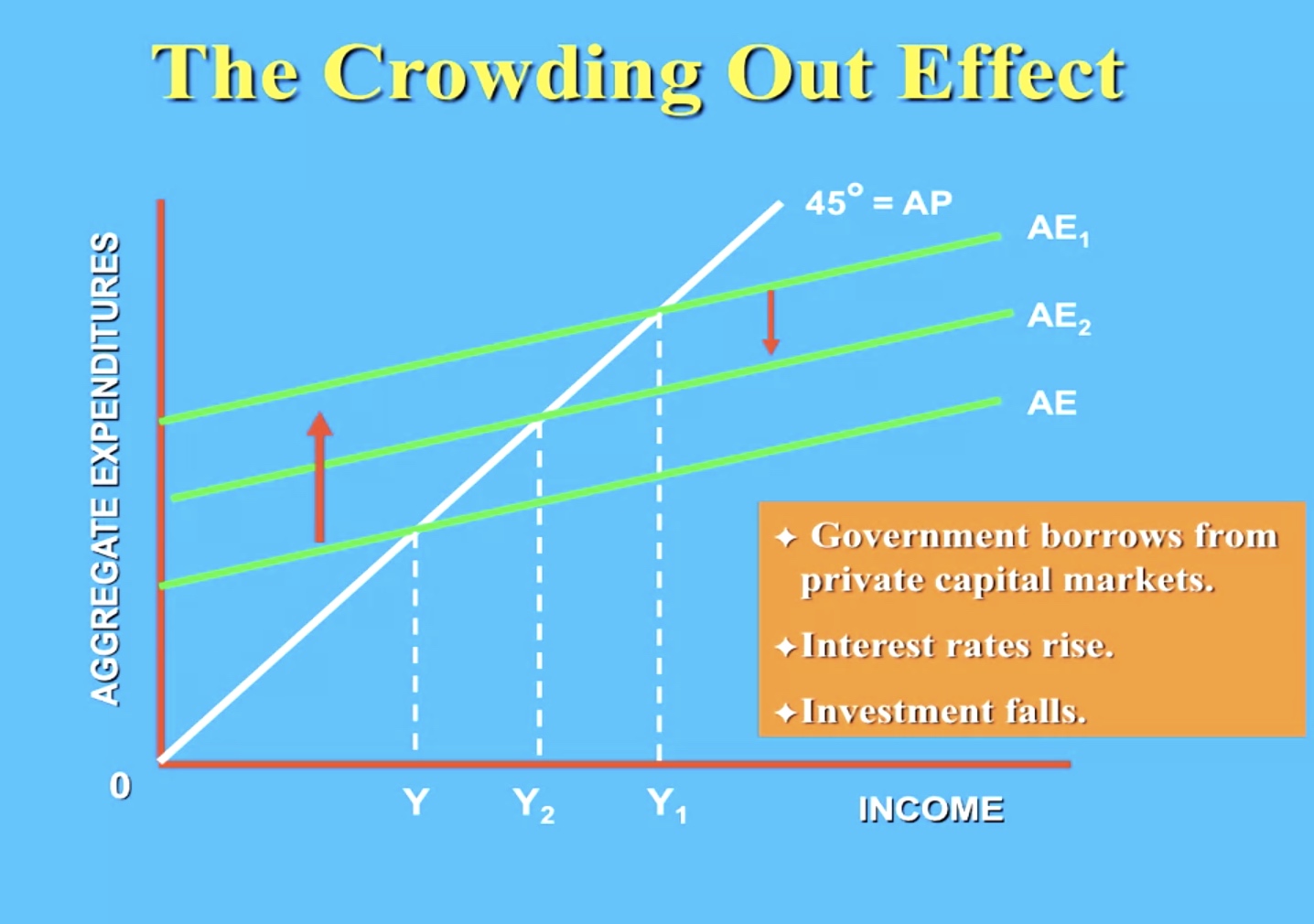

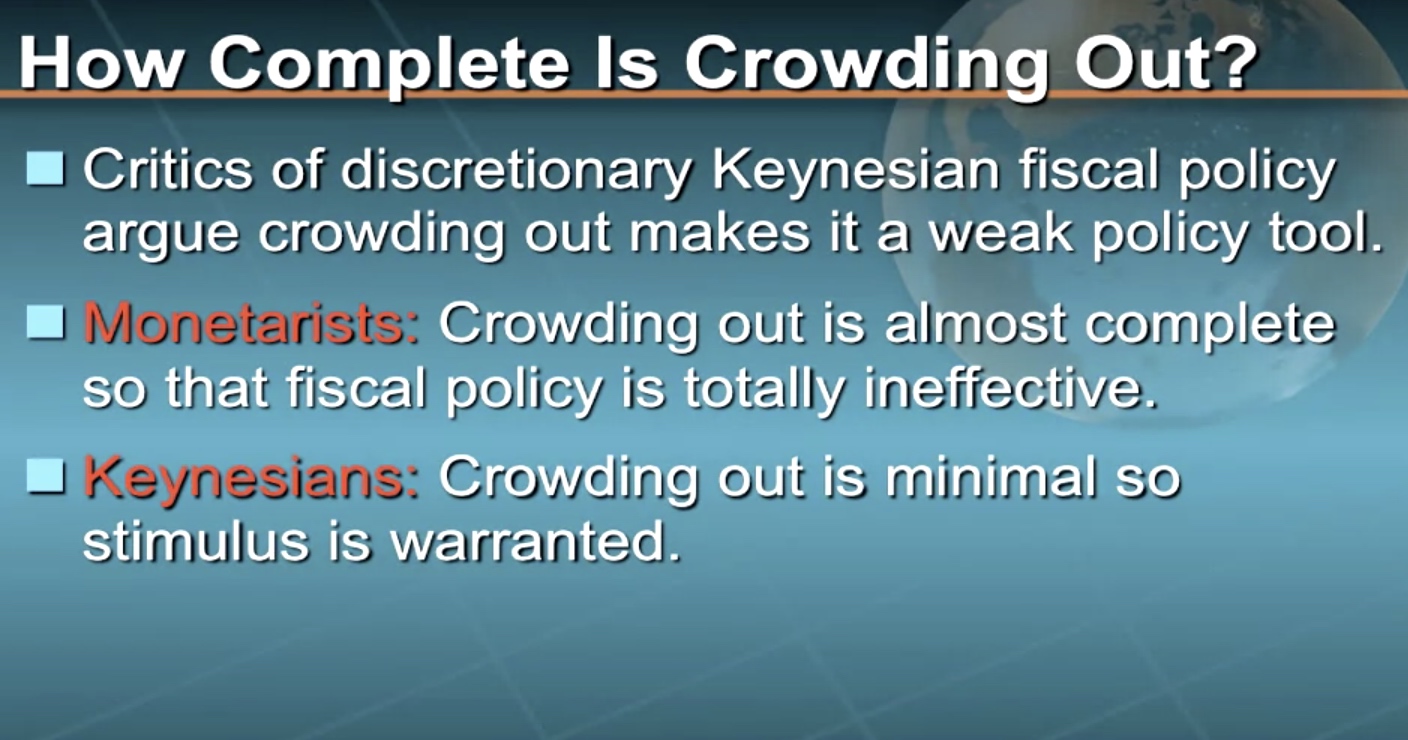

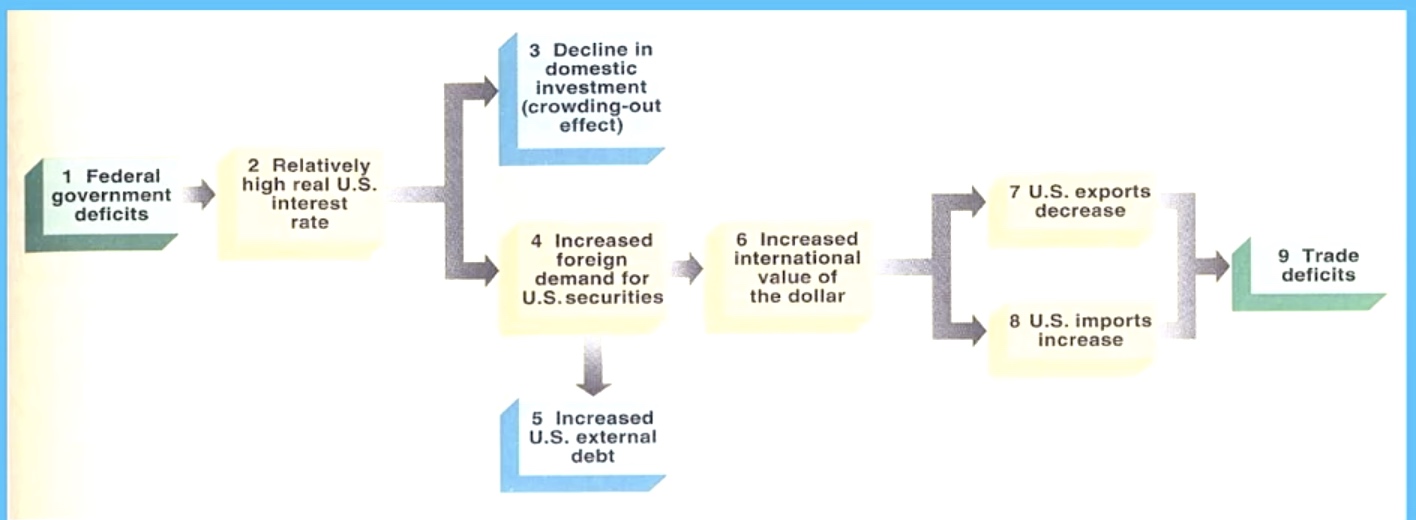

By this module’s end, you should be able to summarize and explain the major arguments for and against chronic deficits. You should also have a firm grasp on the difference between structural and cyclical deficits, be able to provide historical examples of each of these two kinds of deficits, and be able to explain the implications of each kind of deficit for the use of discretionary fiscal policy. Finally, you should be able to illustrate how budget deficits can lead to both trade deficits and the “crowding out” of private investment.

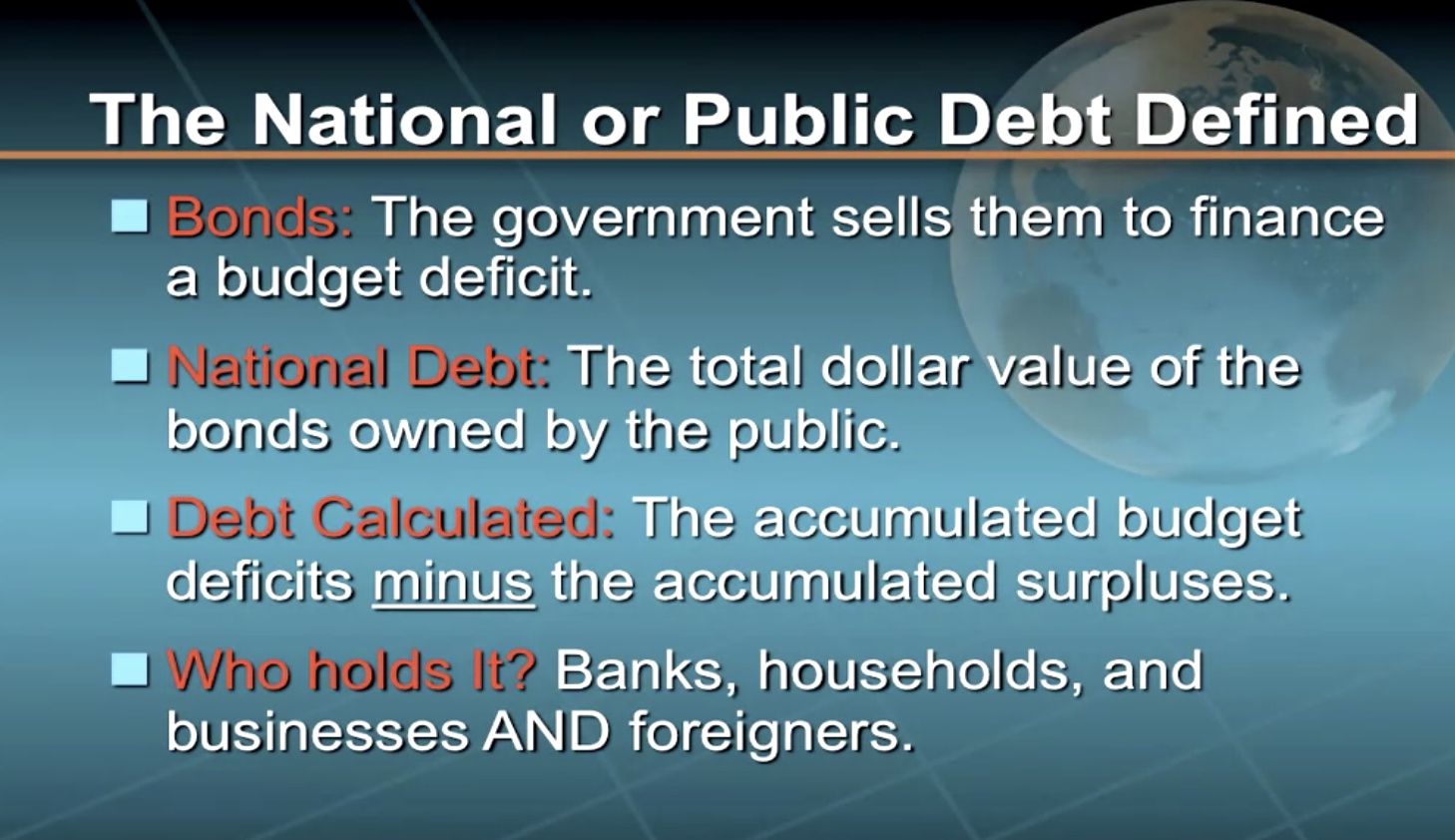

Budget Deficits and the Public Debt Defined

目前中国归属于政府的真实财政收支分为四块,名字分别叫“公共财政收支”、“政府性基金收支”、“社会保障基金收支”、“国有资本经营收支”。目前国有资本收支这一块做账比较混乱,因此不予考量。“公共财政收支”和“政府性基金收支”又可以分别分类为中央和地方总共四块。总的来说,如果将“中央公共财政收支”、“地方公共财政收支”、“中央政府性基金收支”、“地方政府性基金收支”、“社会保障基金收支”、“国有资本经营收支”这六项去除各自之间的内部的支付转移后进行加总,就是中国的真实财政收支了。我们口中常说以及媒体经常提到的“财政收入”往往指“公共财政收入”,它和“政府性基金收入”在核算上几乎是完全没有任何重叠的。“公共财政收入”分为“税收收入”和“非税收收入”,前者好理解,后者在核算上是统计专项收入、行政事业性收费、罚没收入、其他收入几块,是不包括“政府性基金收入”的。“政府性基金收入”中,“地方政府性基金收入”占比九成左右,其中土地出让金又占比超过八成。

从预算体系看,目前我国各级政府预算由公共财政预算、政府性基金预算、国有资本经营预算共同构成。政府各类收入反映政府以行政权力和国有资产所有者身份集中社会资源的规模和份额,都应纳入政府预算体系管理,完整的政府预算体系包括公共财政预算、国有资本经营预算、政府性基金预算,以及社会保障预算。—-来自国家预算体系

The Debt-to-GDP Ratio

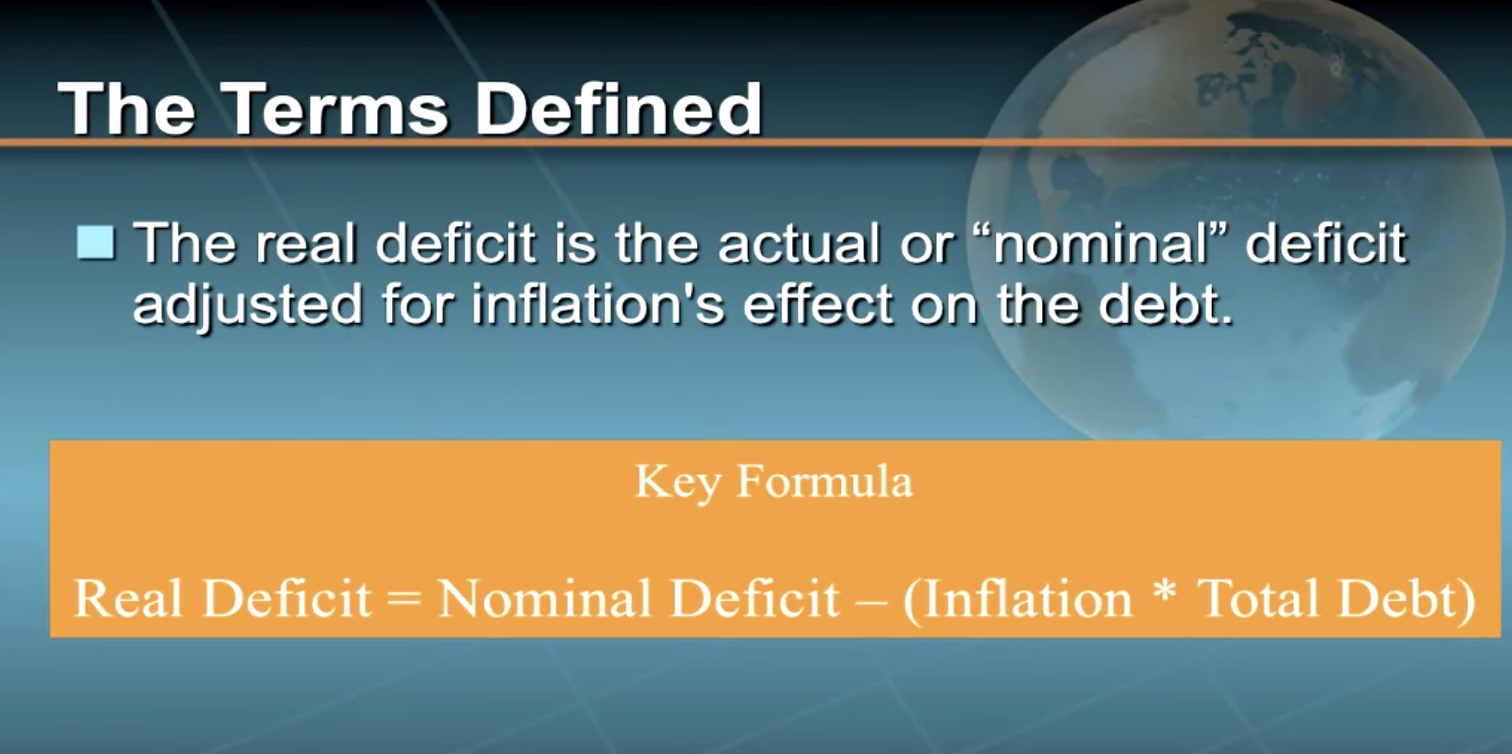

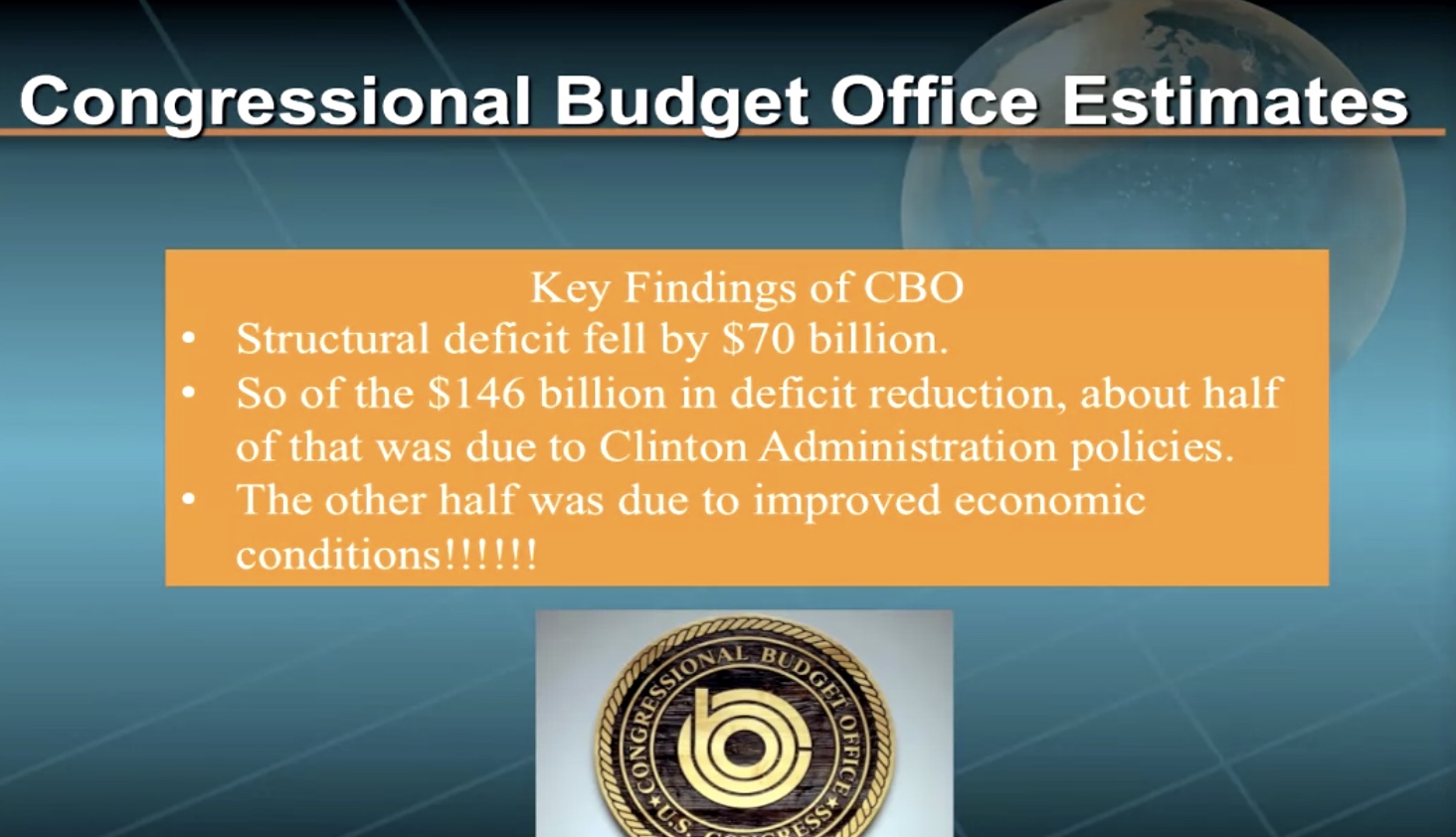

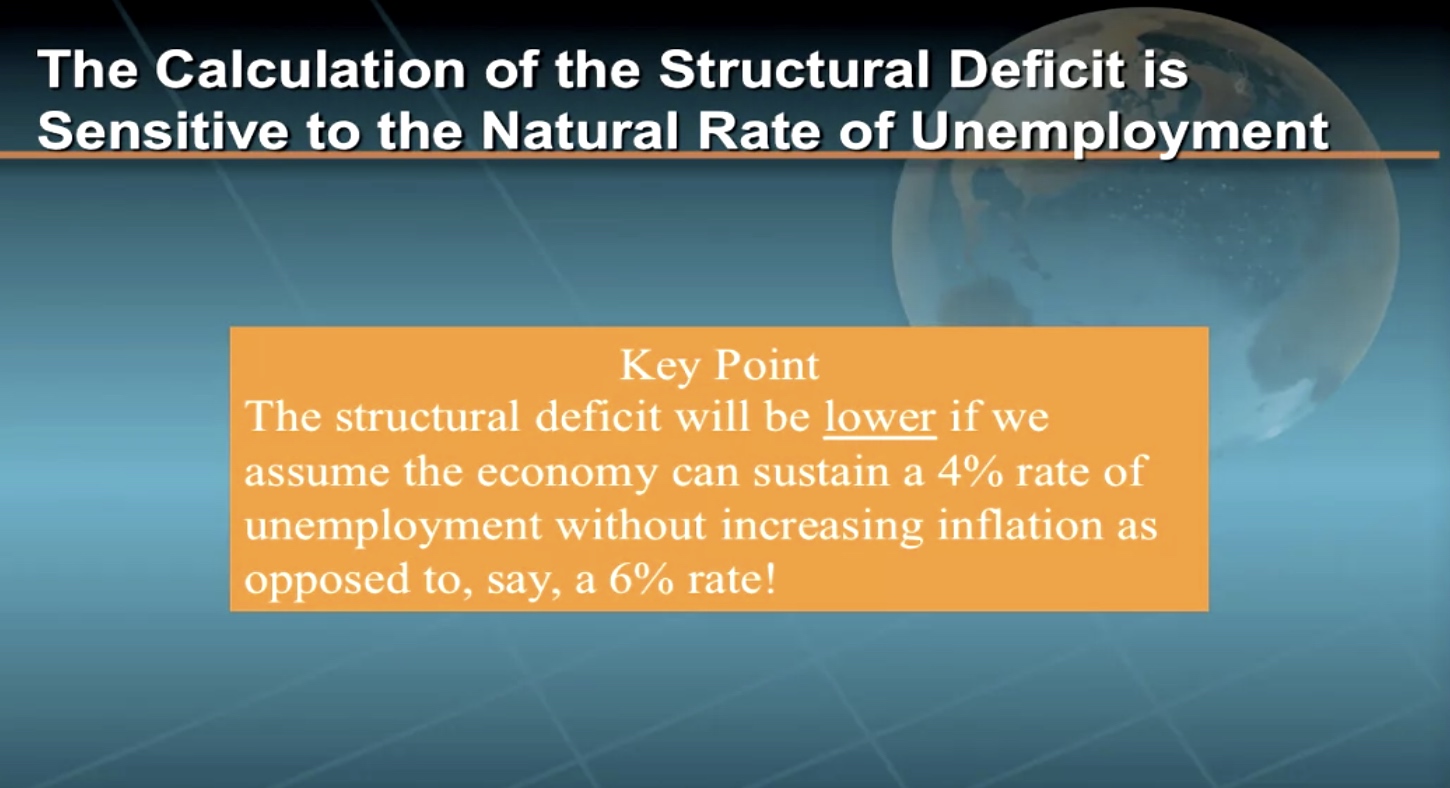

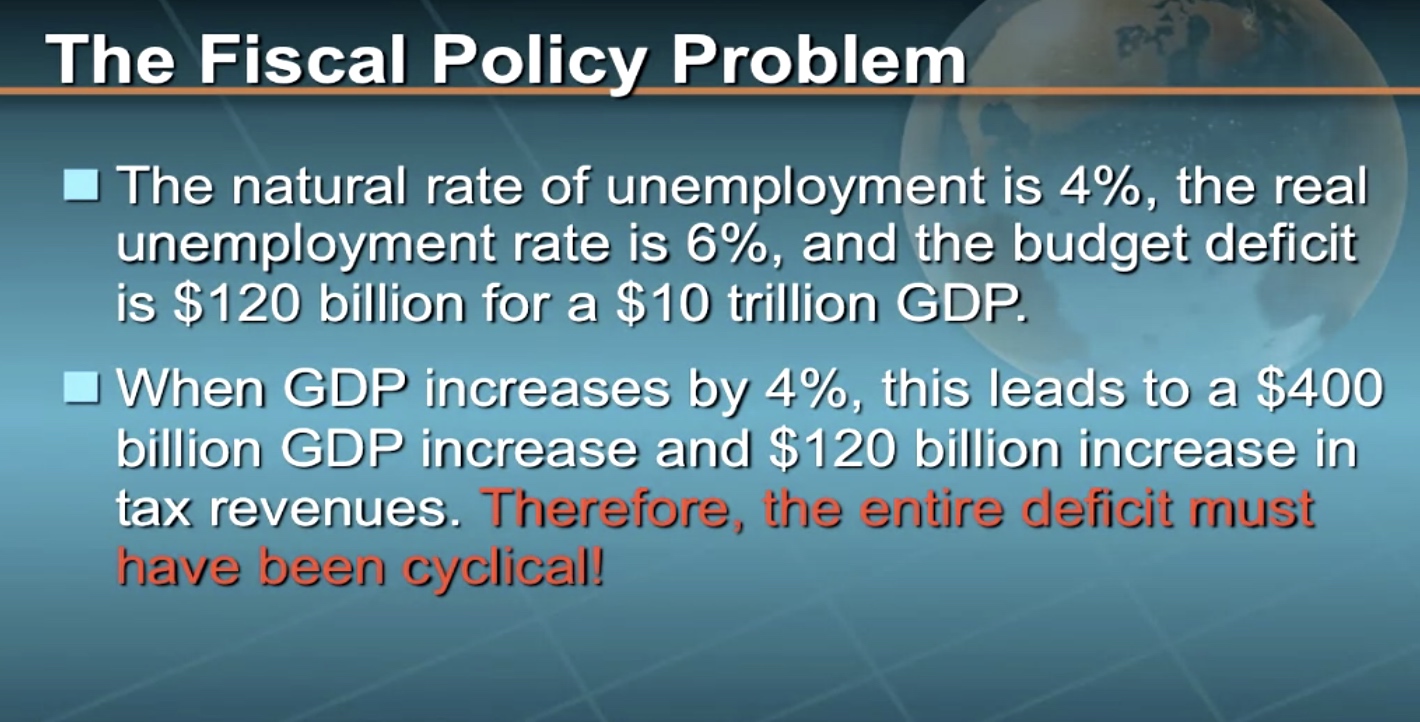

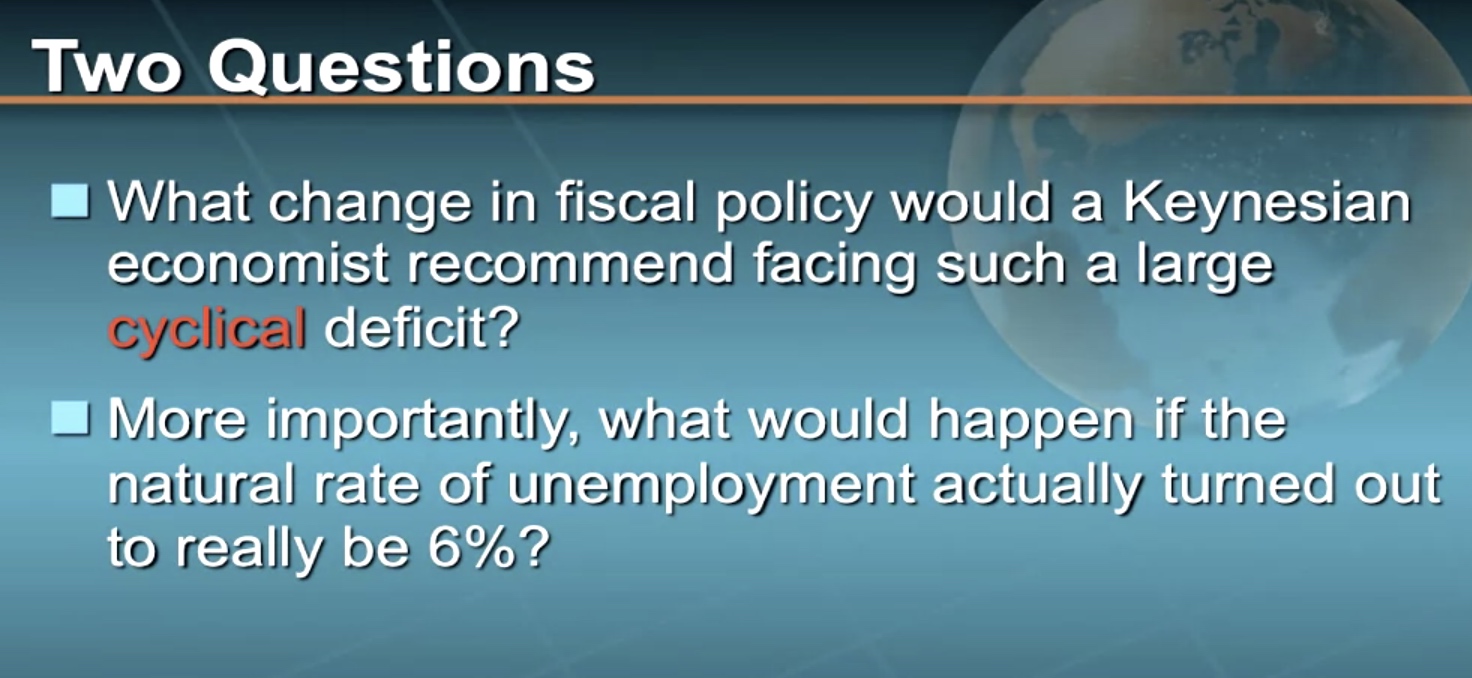

The Debt-to-GDP Ratio, Real Versus Nominal Deficit, Structural Versus Cyclical Deficit

Calculating the Structural and Cyclical Parts of the Budget Deficit

During recession, expansionary fiscal policy can actually decrease the budget deficit, which tends to be a cyclical budget deficit.

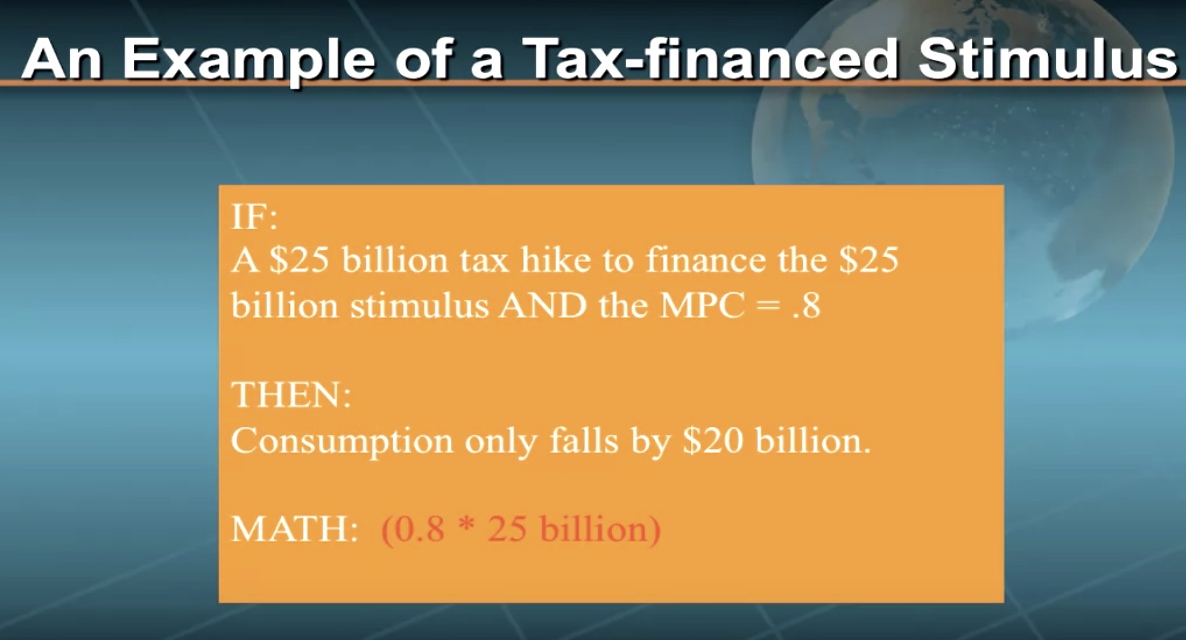

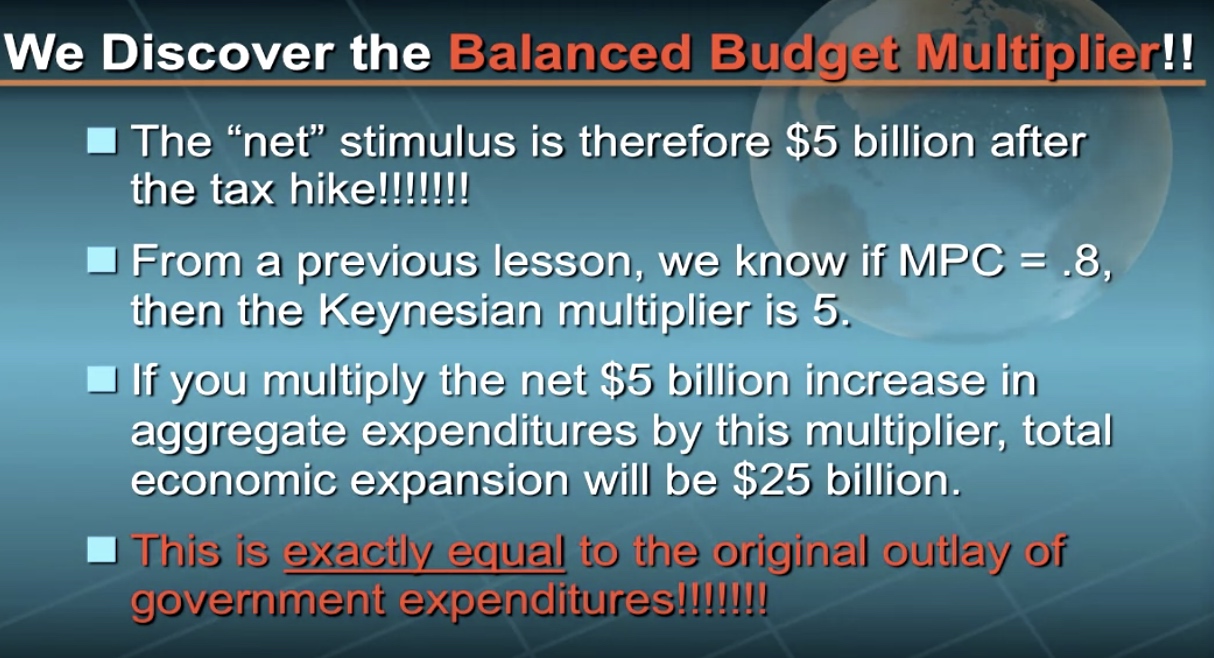

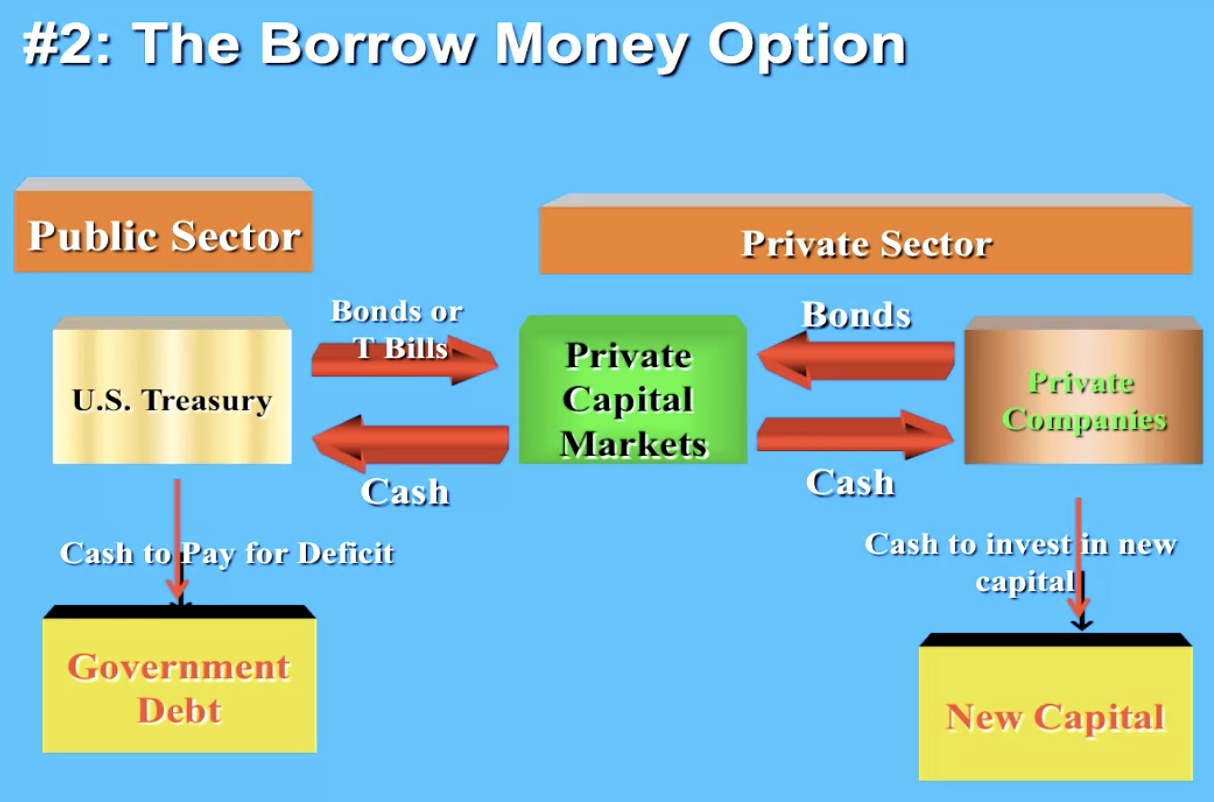

Financing Budget Deficits and Associated Problems

— The Balanced Budget Multiplier

Pro and cons of Public debt

- Less productive

International Trade and Protectionism

NAFTA, GATT and the Euro. Tariffs, quotas, and trade deficits. Dumping, non tariff barriers, and protectionism. This is the language of international economics, and people all across the globe are speaking it in newspapers, corporate offices, retail stores, and union halls.

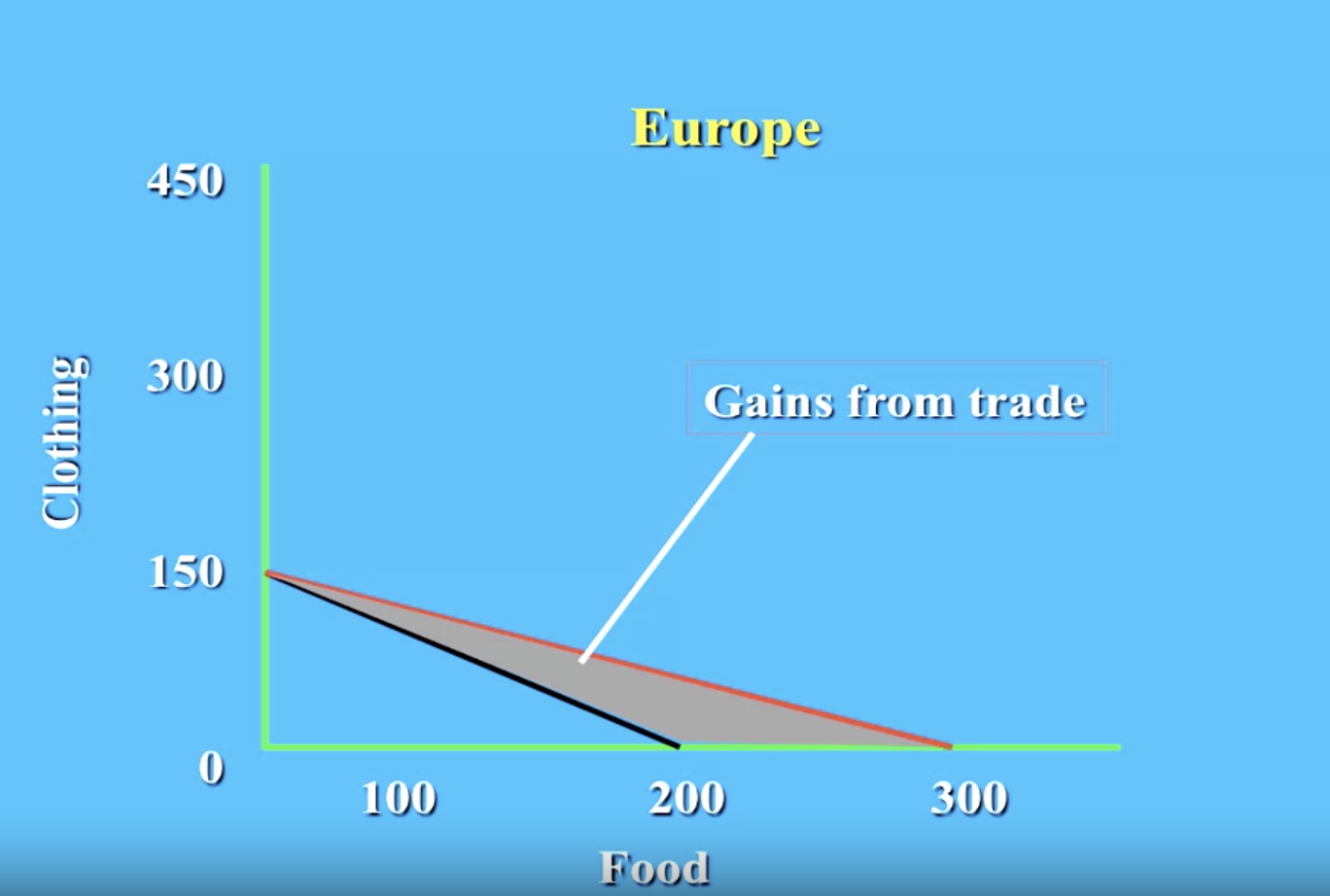

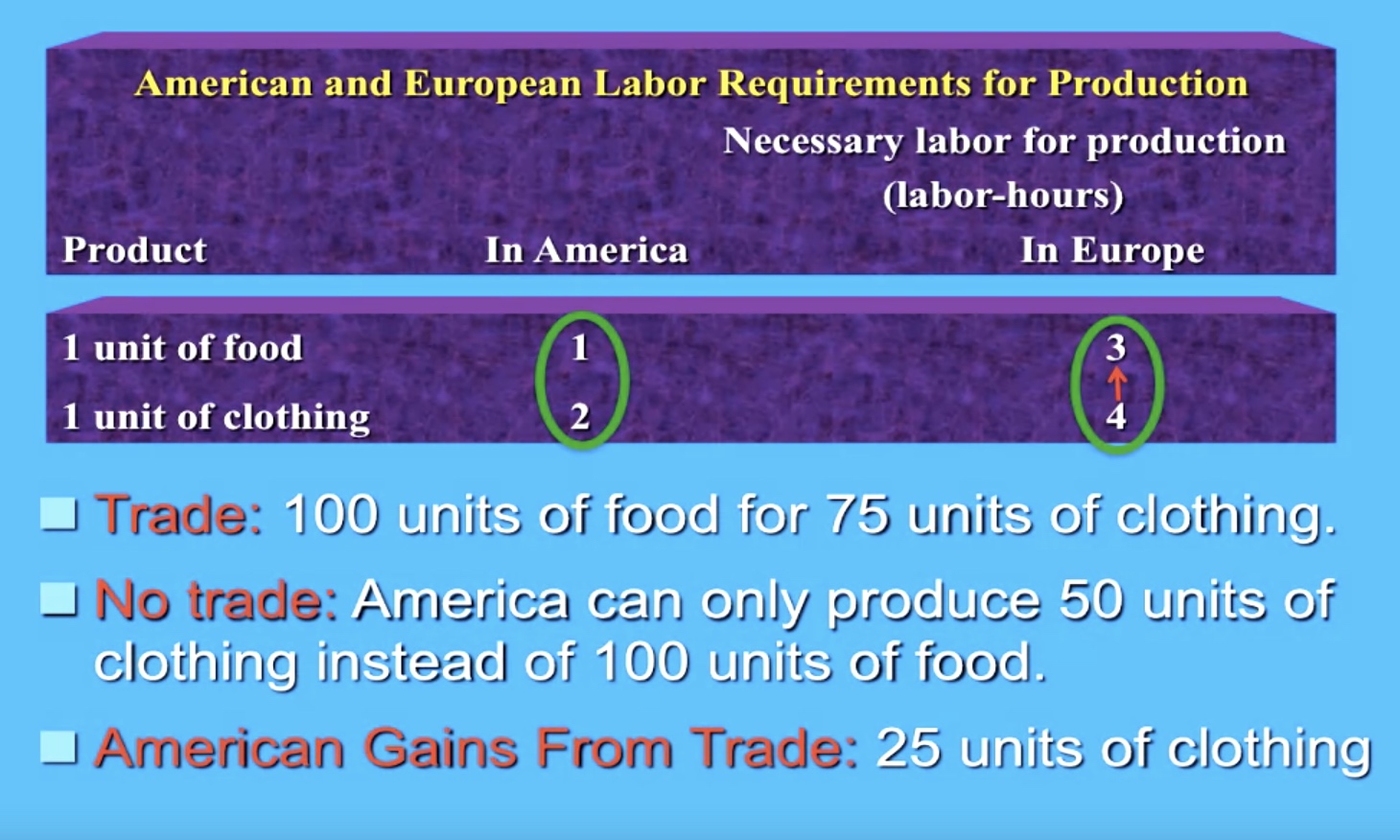

In the next two modules, we are going to look very closely at some important issues in international trade. To begin this module, we will look from a theoretical perspective at why nations trade. In doing so, we will learn about Adam Smith’s theory of absolute advantage and its much more compelling cousin, David Ricardo’s theory of comparative advantage. We will also demonstrate the gains from trade.

Once we get these concepts down, we will turn to the thorny issue of trade barriers and protectionism, taking special care to explain the important economic and political differences between protectionist tools such as tariffs, quotas, and non-tariff barriers. After a discussion of the pros and cons of protectionism, we will then end the module with an examination of important multi-lateral trade agreements such as those embodied in NAFTA and the GATT.

Key Questions:

-

Explain the theory of absolute advantage.

-

Explain the theory of comparative advantage.

-

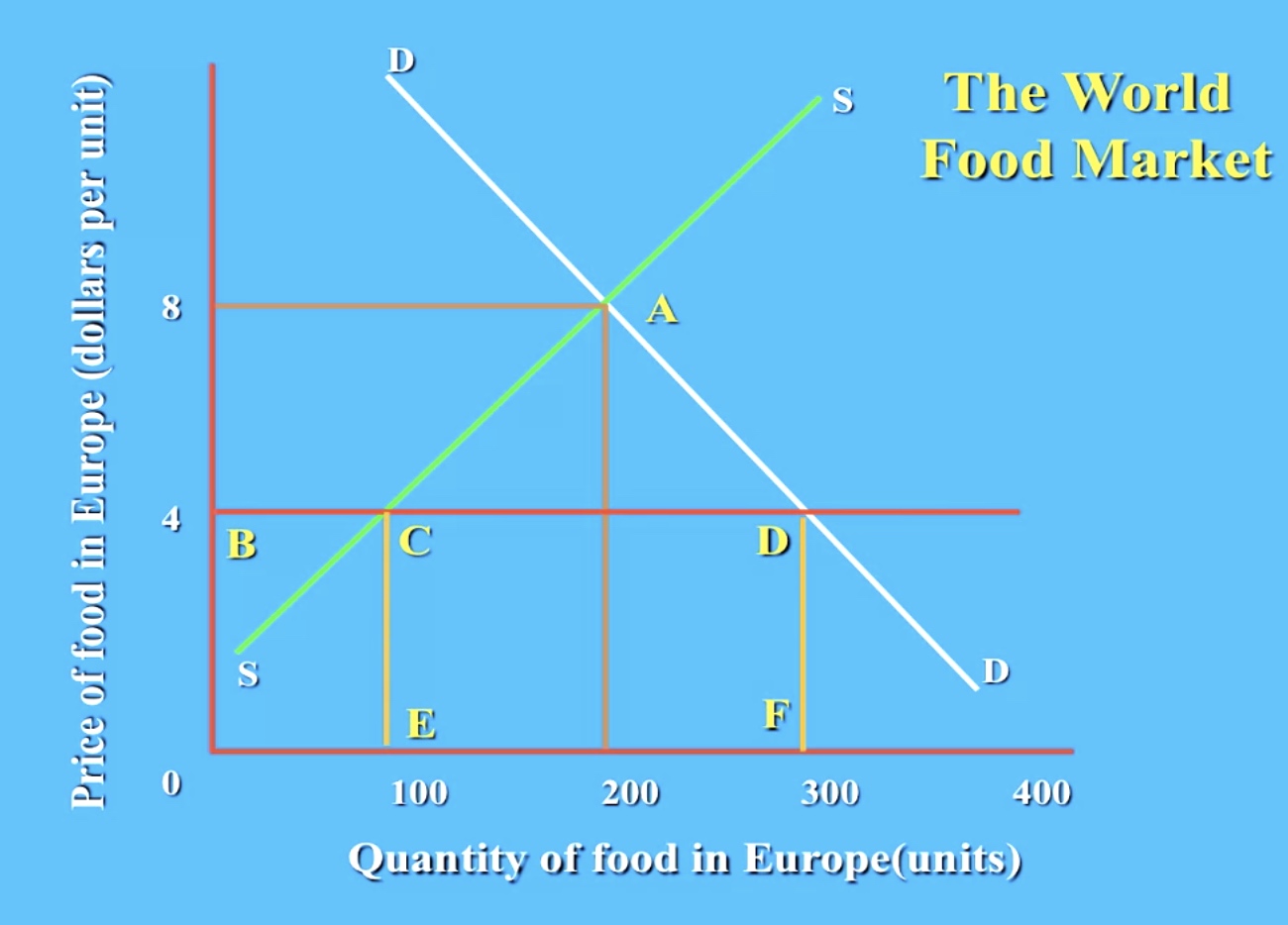

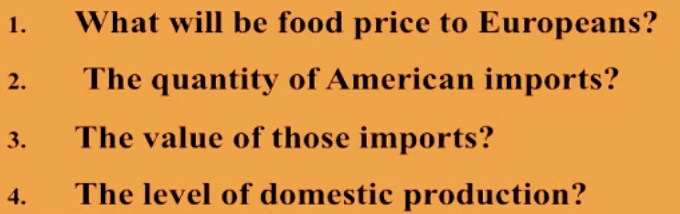

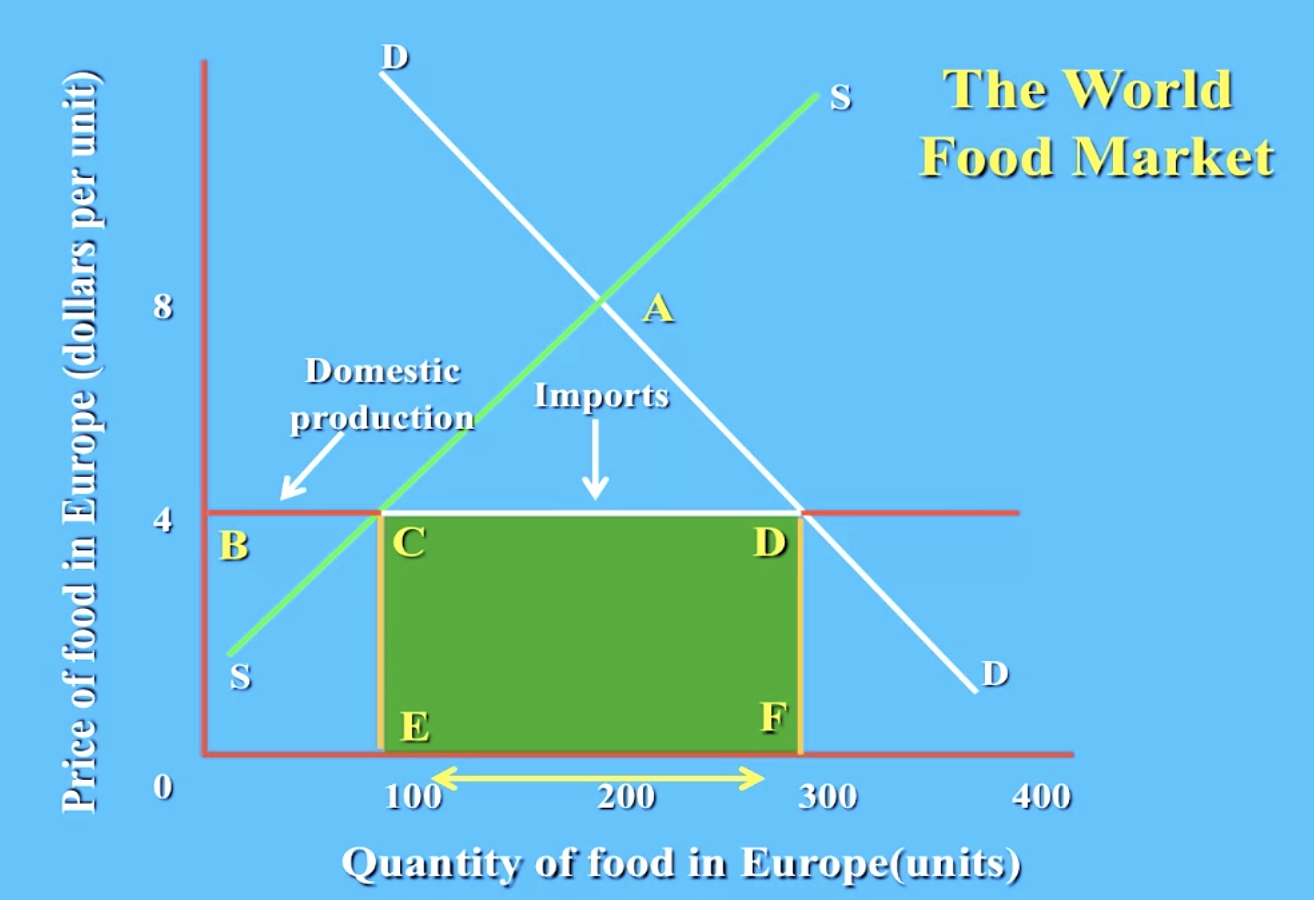

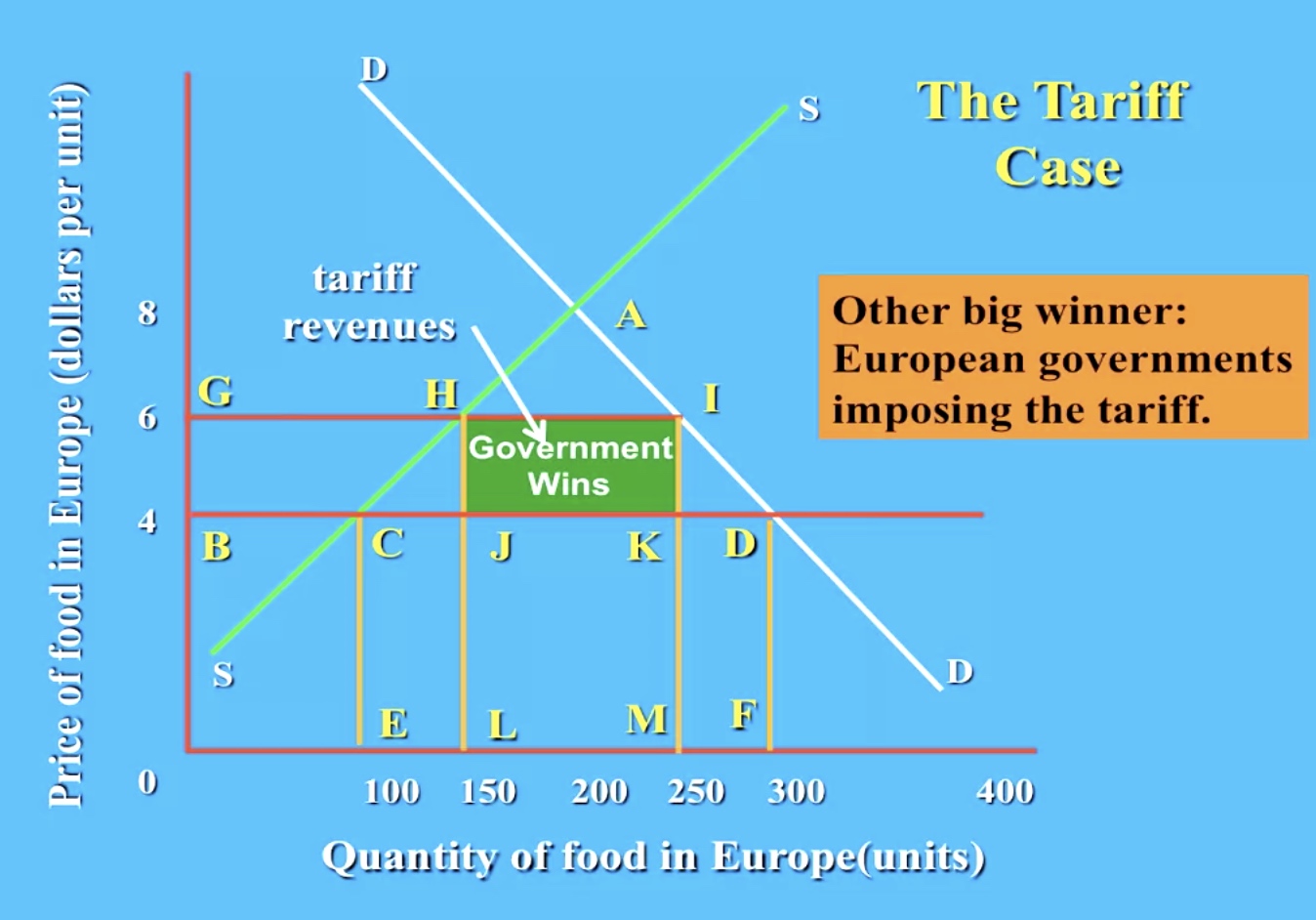

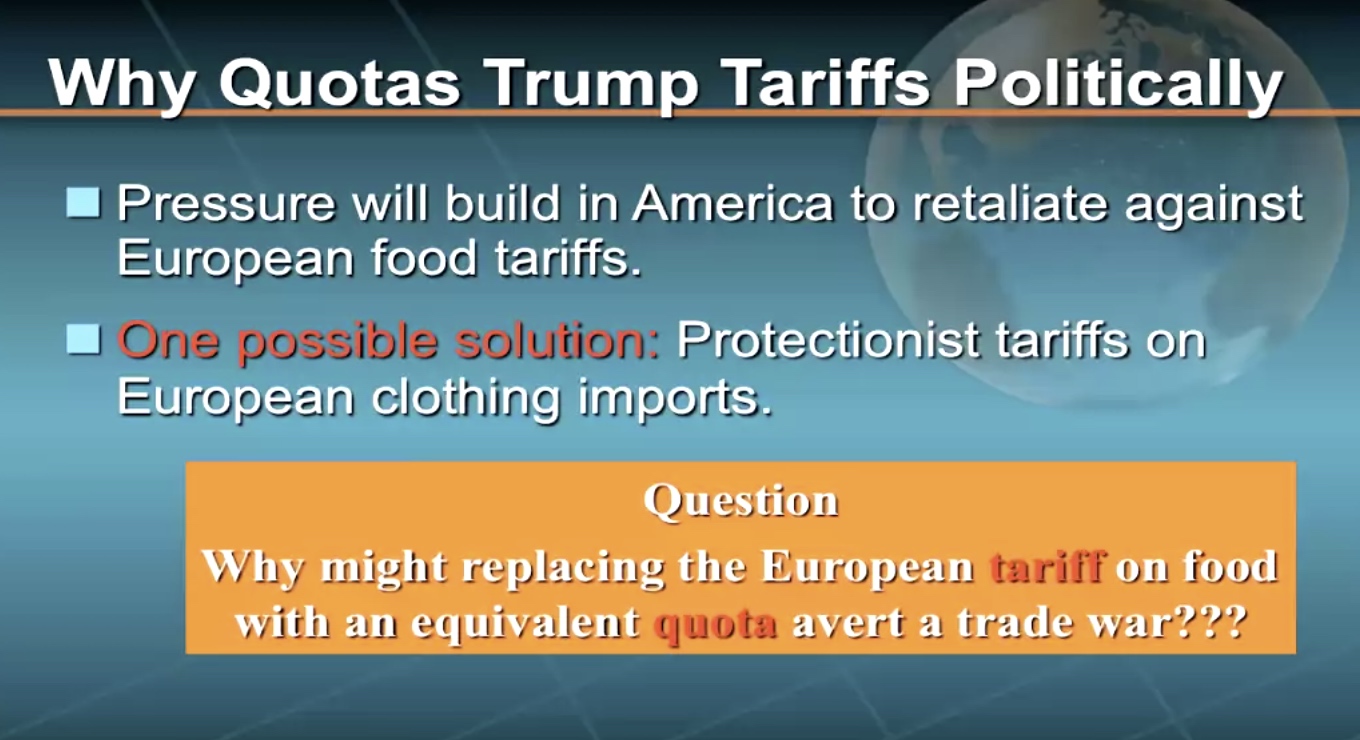

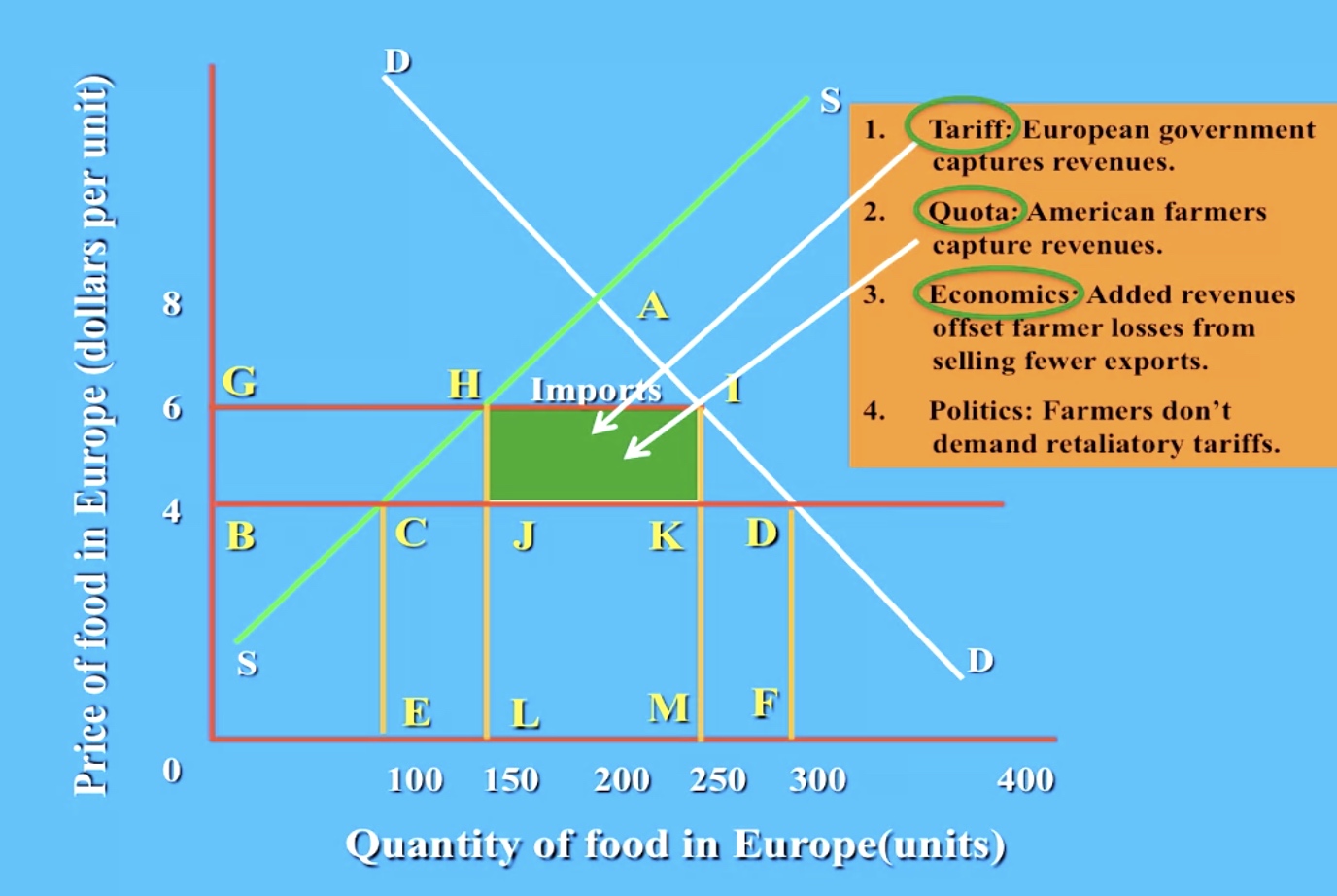

What is the difference between a tariff and a quota?

-

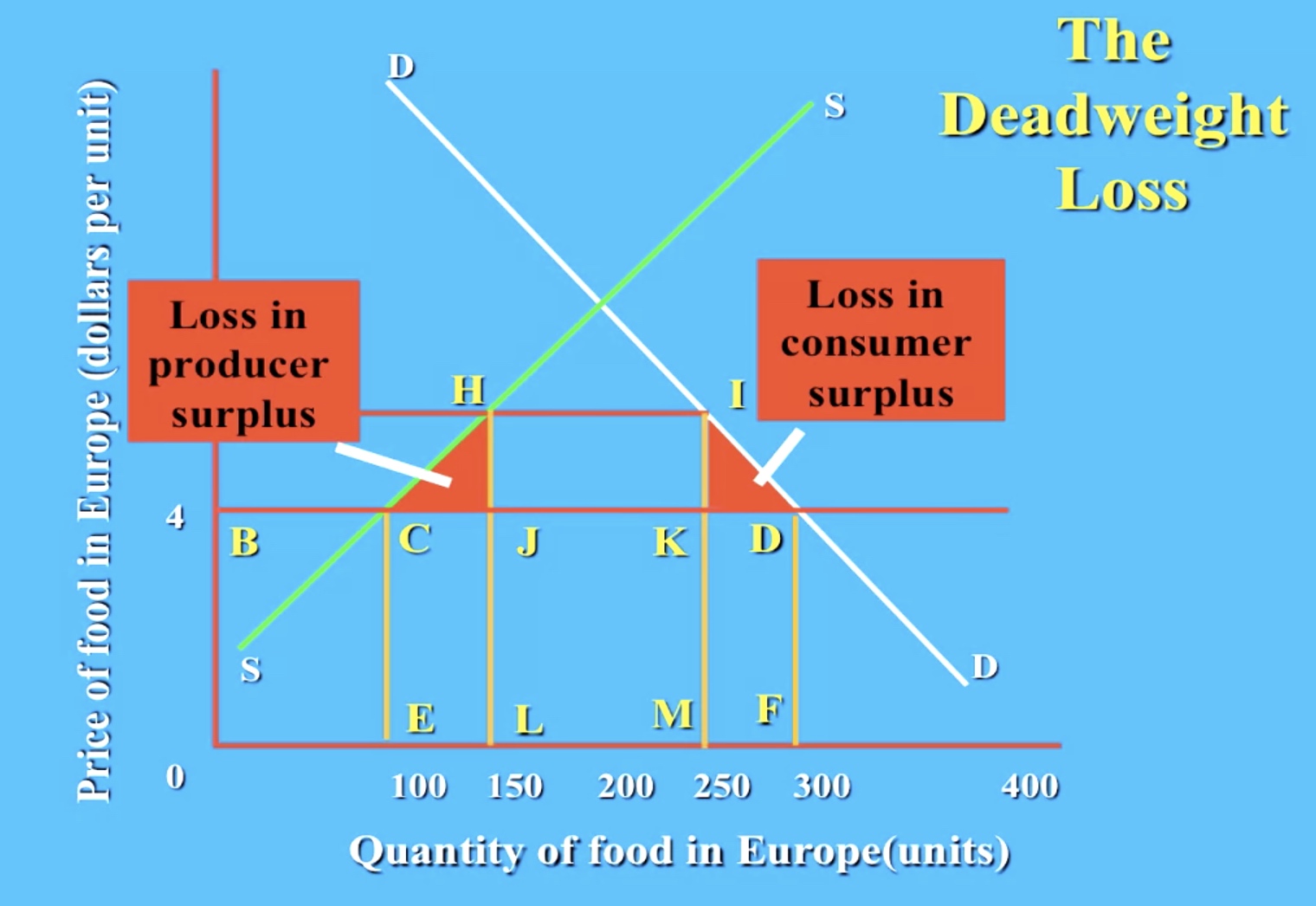

Illustrate the deadweight loss of a tariff versus a quota.

-

Why, from a political perspective, are quotas often preferred to tariffs?

-

Briefly summarize the six major arguments in support of protectionism.

-

When does dumping occur?

-

Provide several examples of non-tariff barriers to trade.

-

What is the GATT?

-

What is NAFTA?

-

Describe the European Union.

Absolute Versus Comparative Advantage

Tariff, Quotas, Trade Barriers, Protectionism, and the Dead Weight Loss

The Pros and Cons of Protectionism

Ricardian Free Trade Model

Exchange Rates, The Balance of Payments, and Trade Deficits

This module explains how exchange rates and our international monetary system work and illustrates how fiscal and monetary policies may-or may not-be used in a global economy. The discussion takes place largely within the context of America’s chronic trade deficits.

Beginning in the early 1980s, America began running huge trade deficits. Over the years, these trade deficits have led to an accumulated net foreign debt of trillions of dollars, making the U.S. the largest debtor nation in the world.

To many observers, America’s chronic trade deficits are every bit as dangerous as its chronic budget deficits. Others, however, see the trade deficits simply as an opportunity to buy inexpensive foreign goods and enjoy a higher standard of living that Americans could otherwise not achieve.

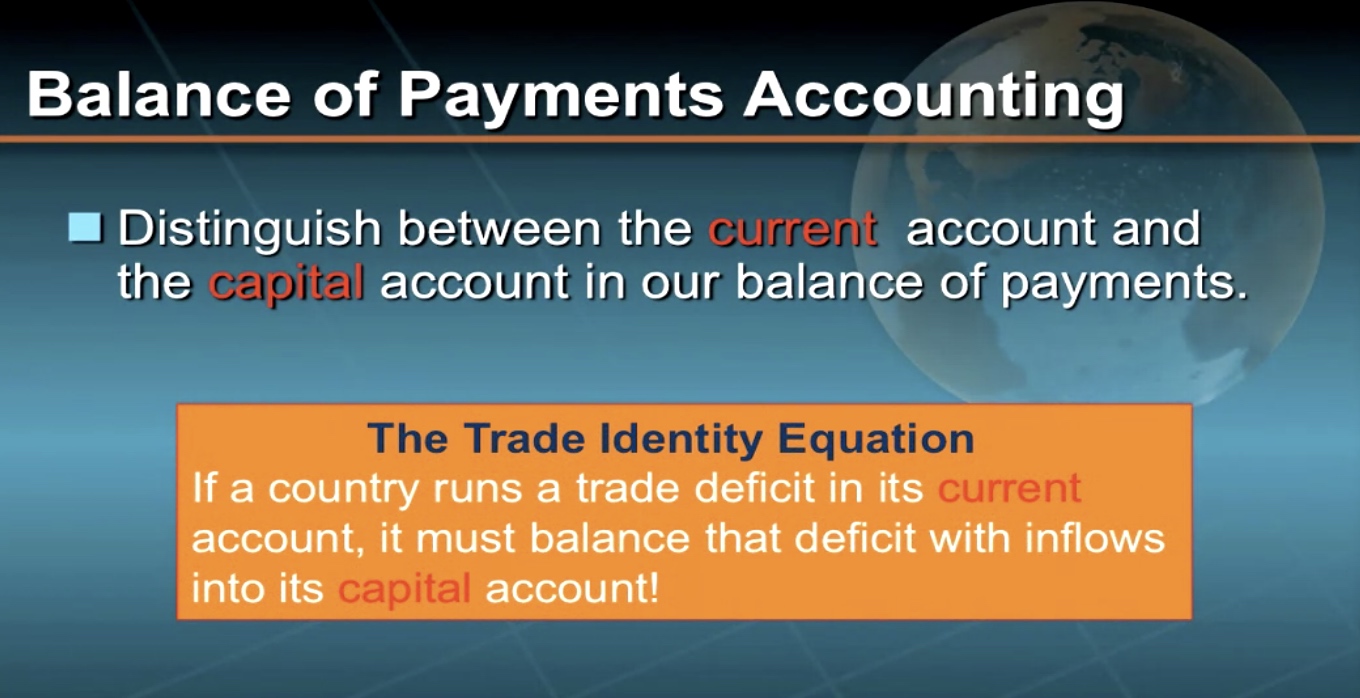

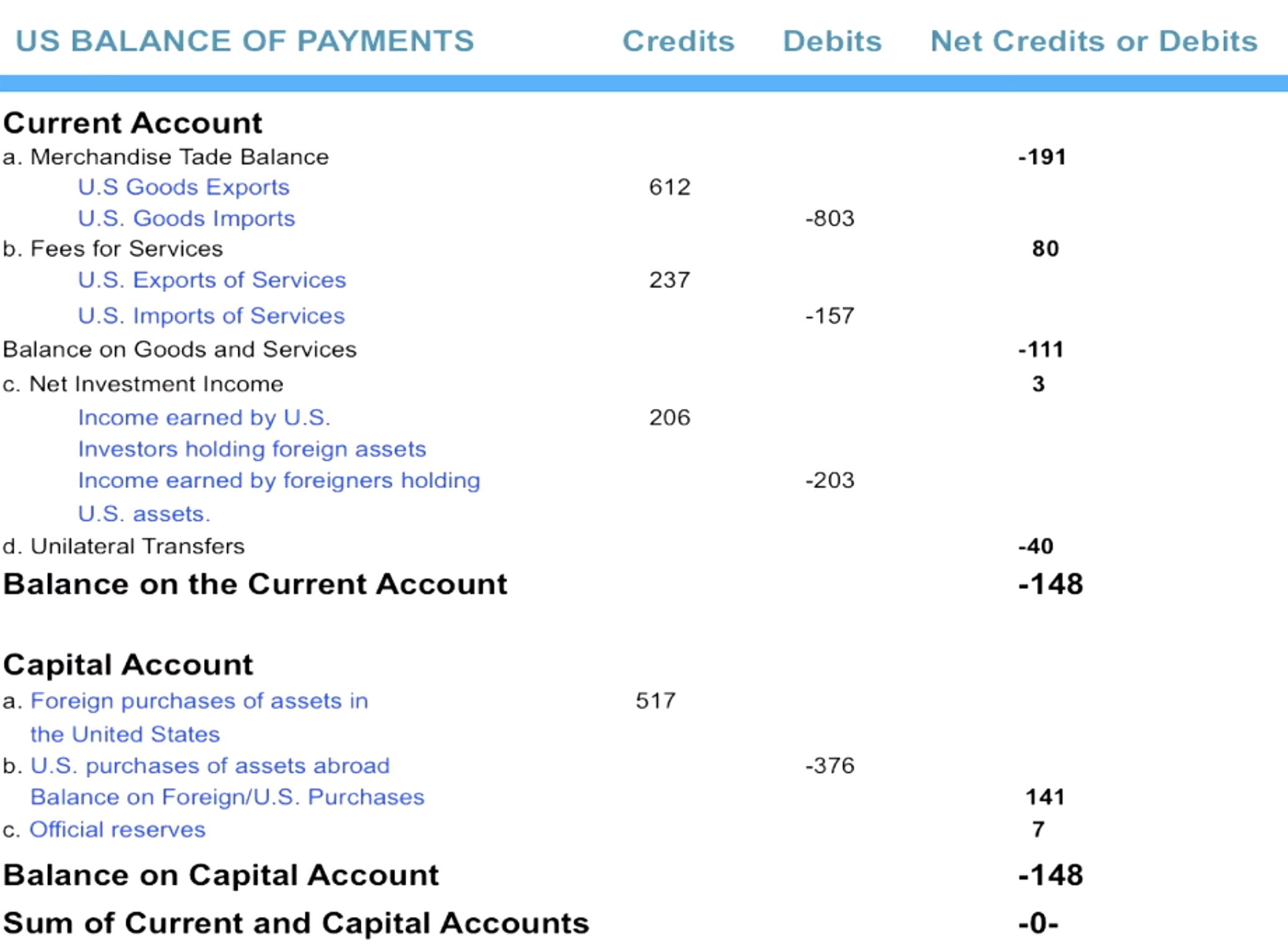

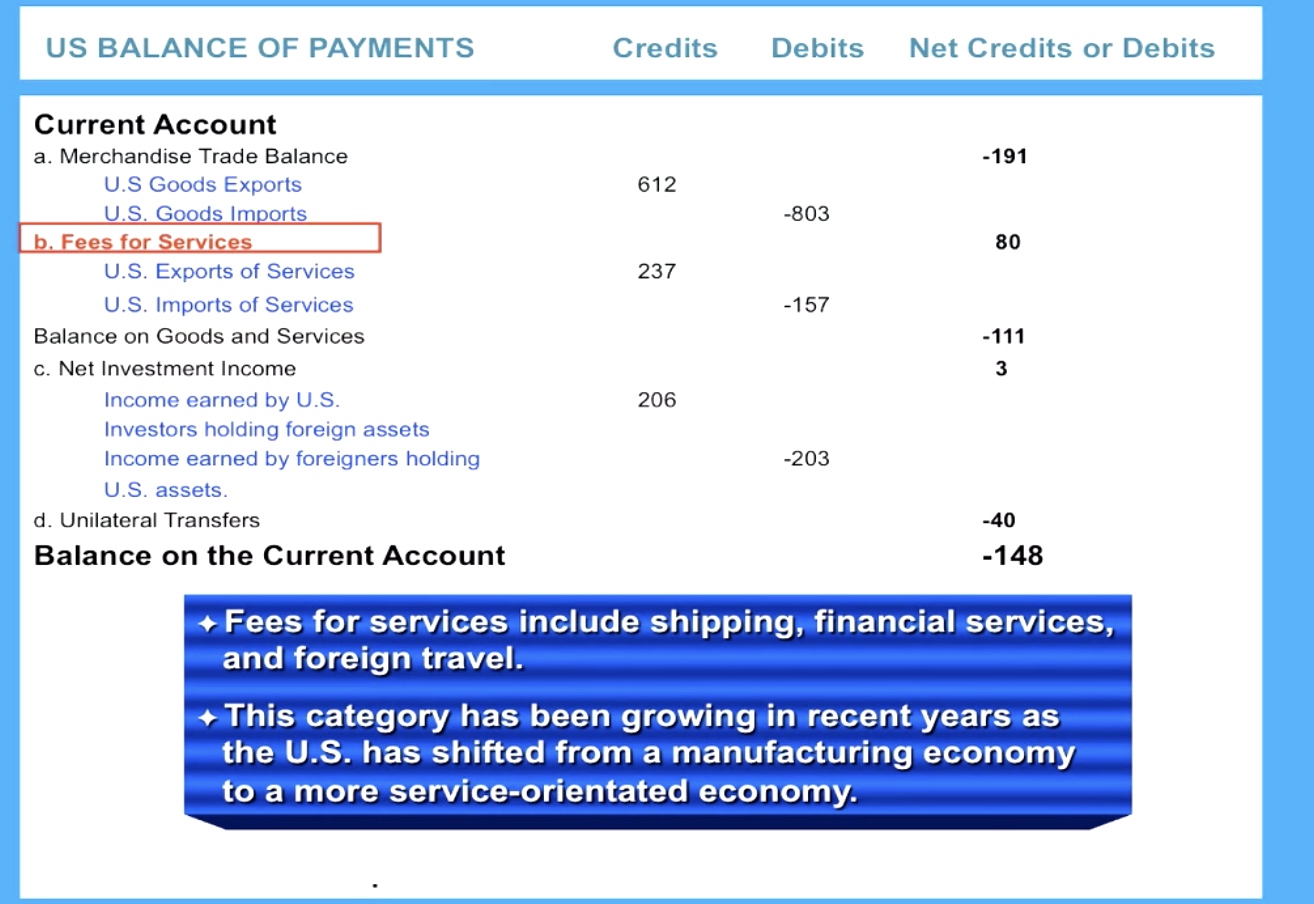

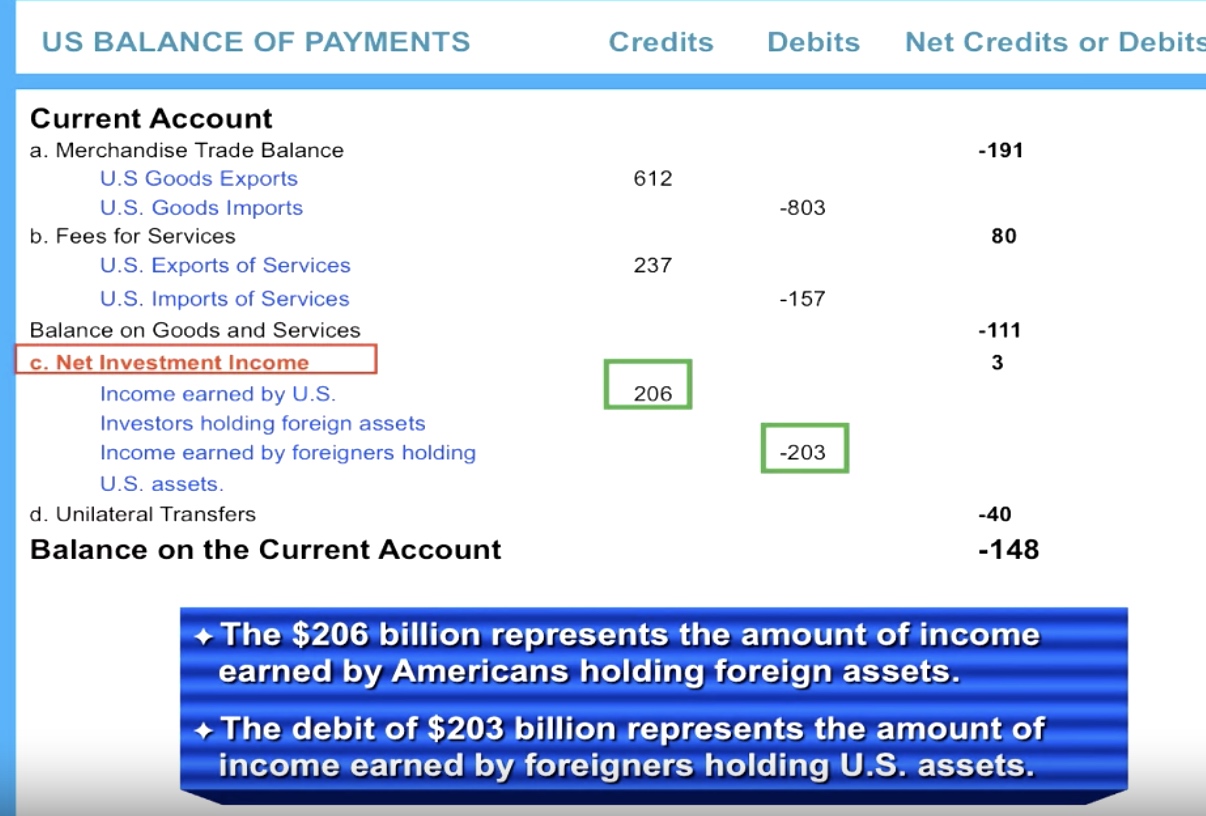

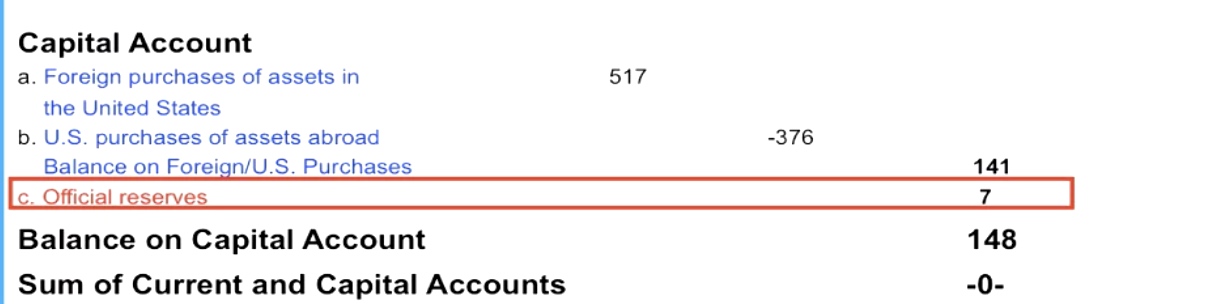

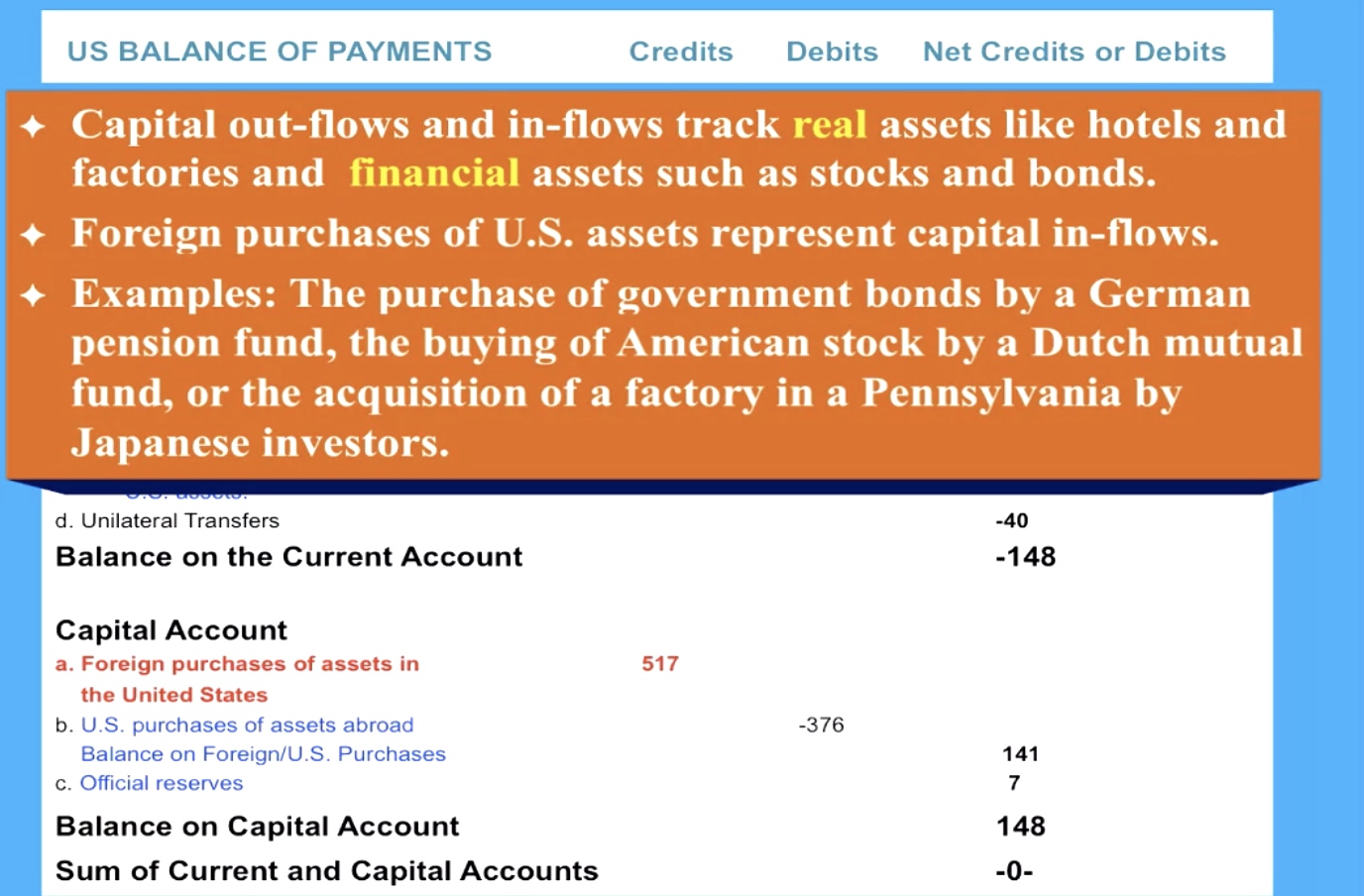

To understand the roots and scope of the trade deficit problem, we must first learn some basic “balance of payments” accounting. Then, we will describe how exchange rates work and how the international monetary system is structured.

Once we get these fundamentals down, we can then talk about the important impacts that domestic fiscal and monetary policies can have on foreign capital markets and the trade deficit. From this discussion, we will also come to understand more fully the important link between the budget and trade deficits and why it is increasingly important for the nations of the world to coordinate their fiscal and monetary policies in a global economy.

Key Questions:

-

What is the basic trade identity equation?

-

What are the three major components of the Current Account? Which is the biggest?

-

Define an exchange rate.

-

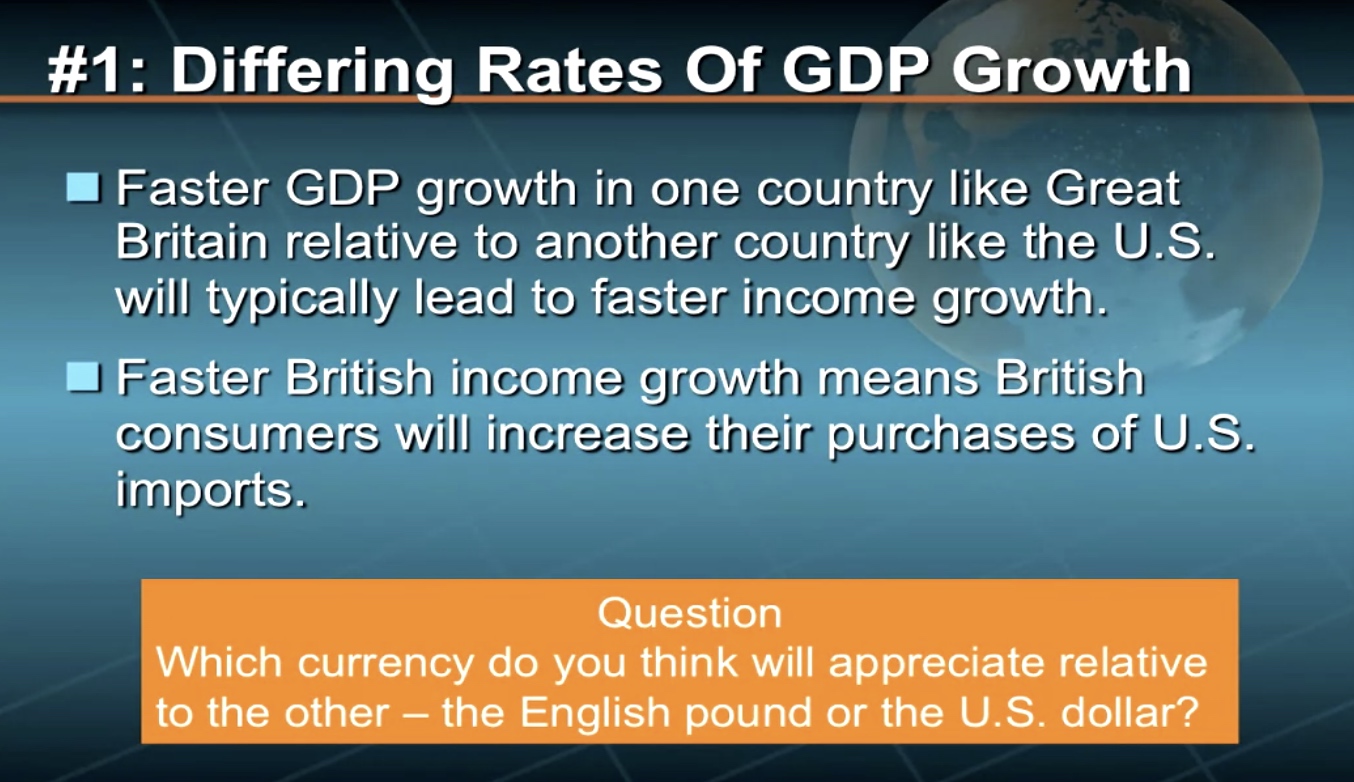

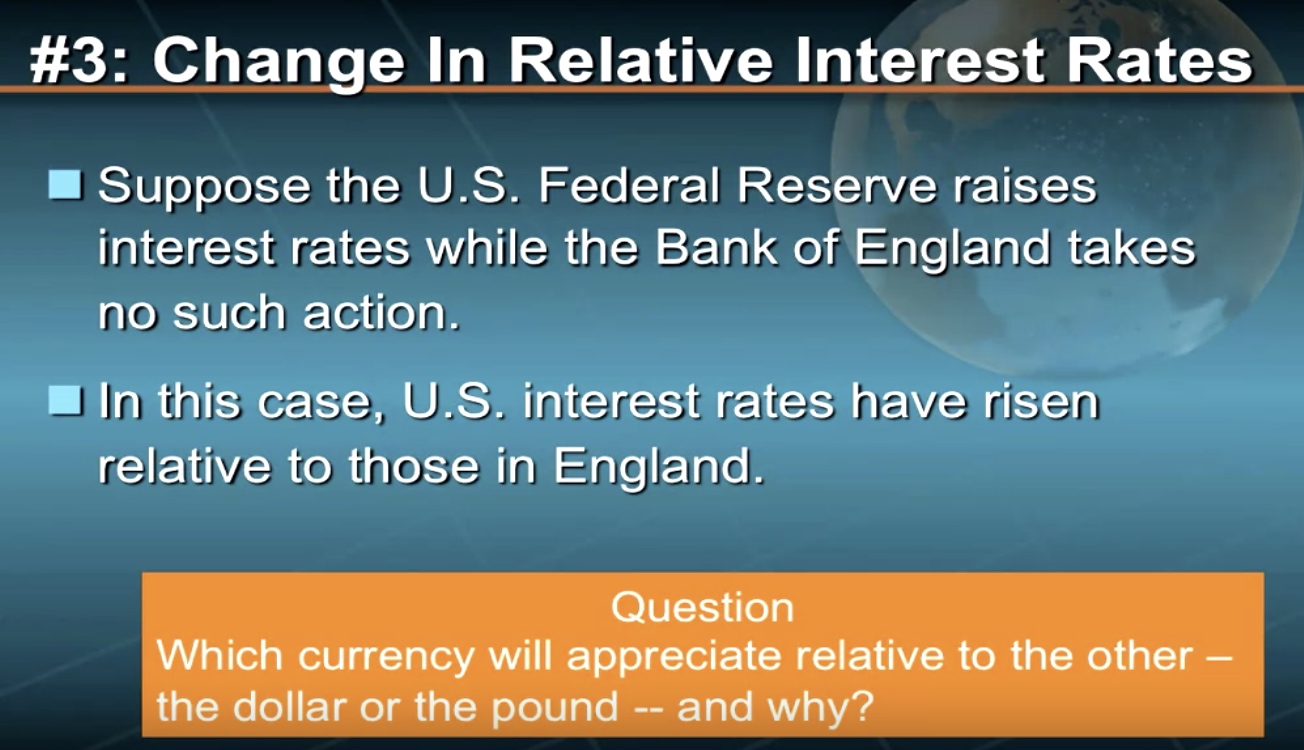

Explain the three major reasons why exchange rates change.

-

Describe the gold standard. When and why did it collapse?

-

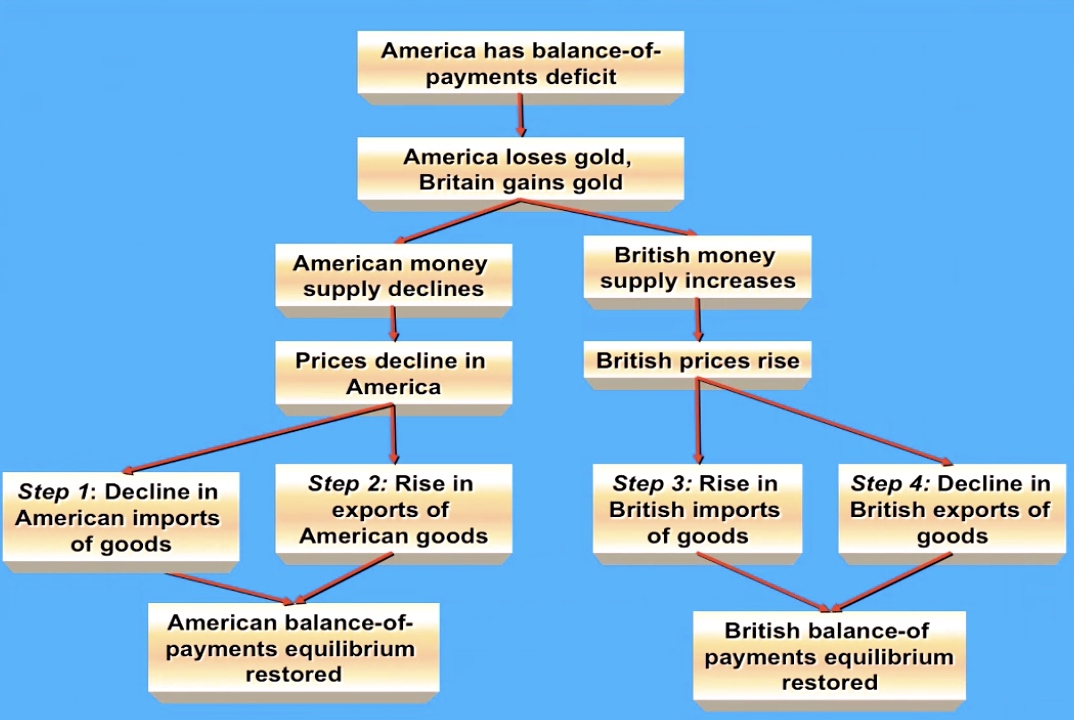

Explain the gold specie flow mechanism.

-

What was the major difference between the gold standard and the Bretton Woods system? When and why did Bretton Woods collapse?

-

Describe the current international monetary system.

-

What is an exchange-rate intervention?

-

What are the three major causes of the chronic trade deficits of the United States?

-

Illustrate the multiplier link.

-

Suppose that America wants to reduce its trade deficit with Japan. What might the United States encourage Japan to do?

-

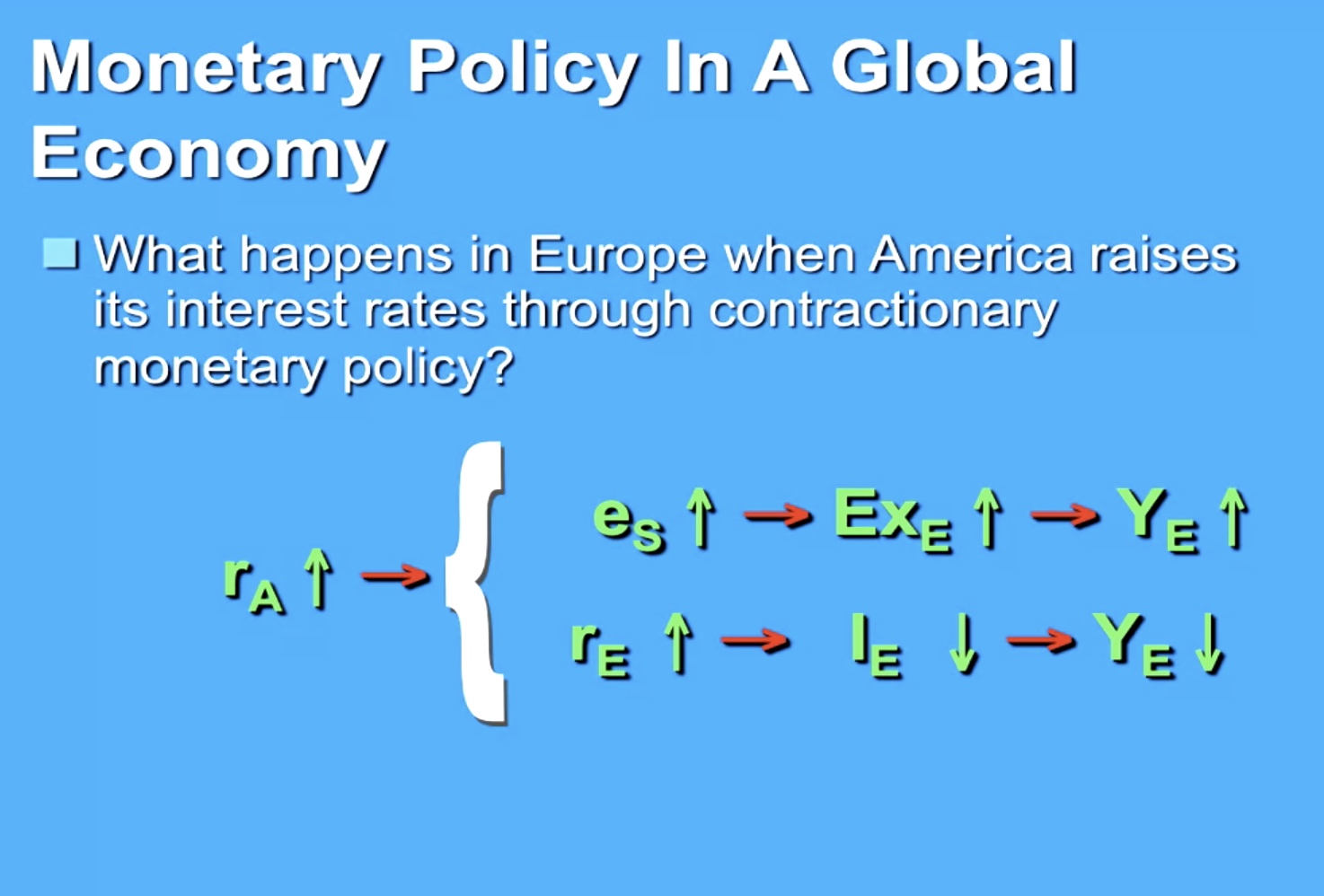

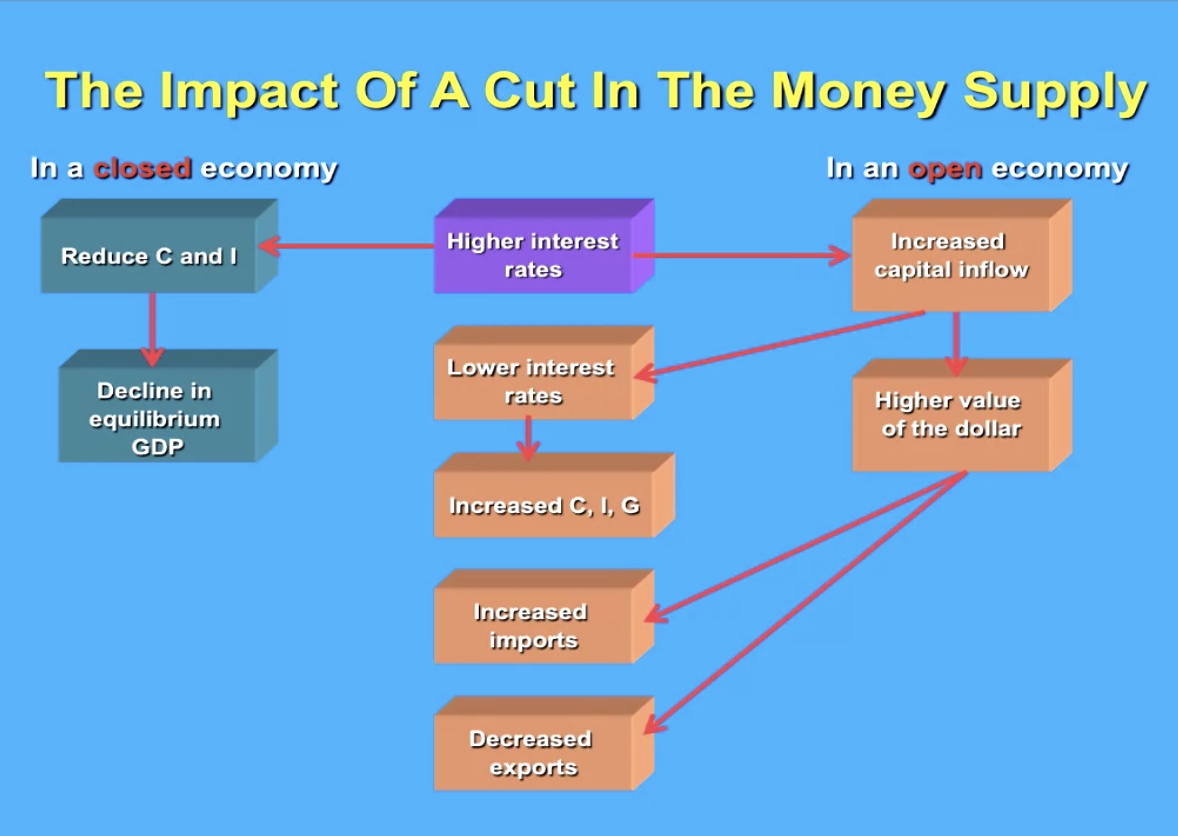

Illustrate the monetary link.

-

Explain some of the difficulties of coordinating macroeconomic policies between countries.

-

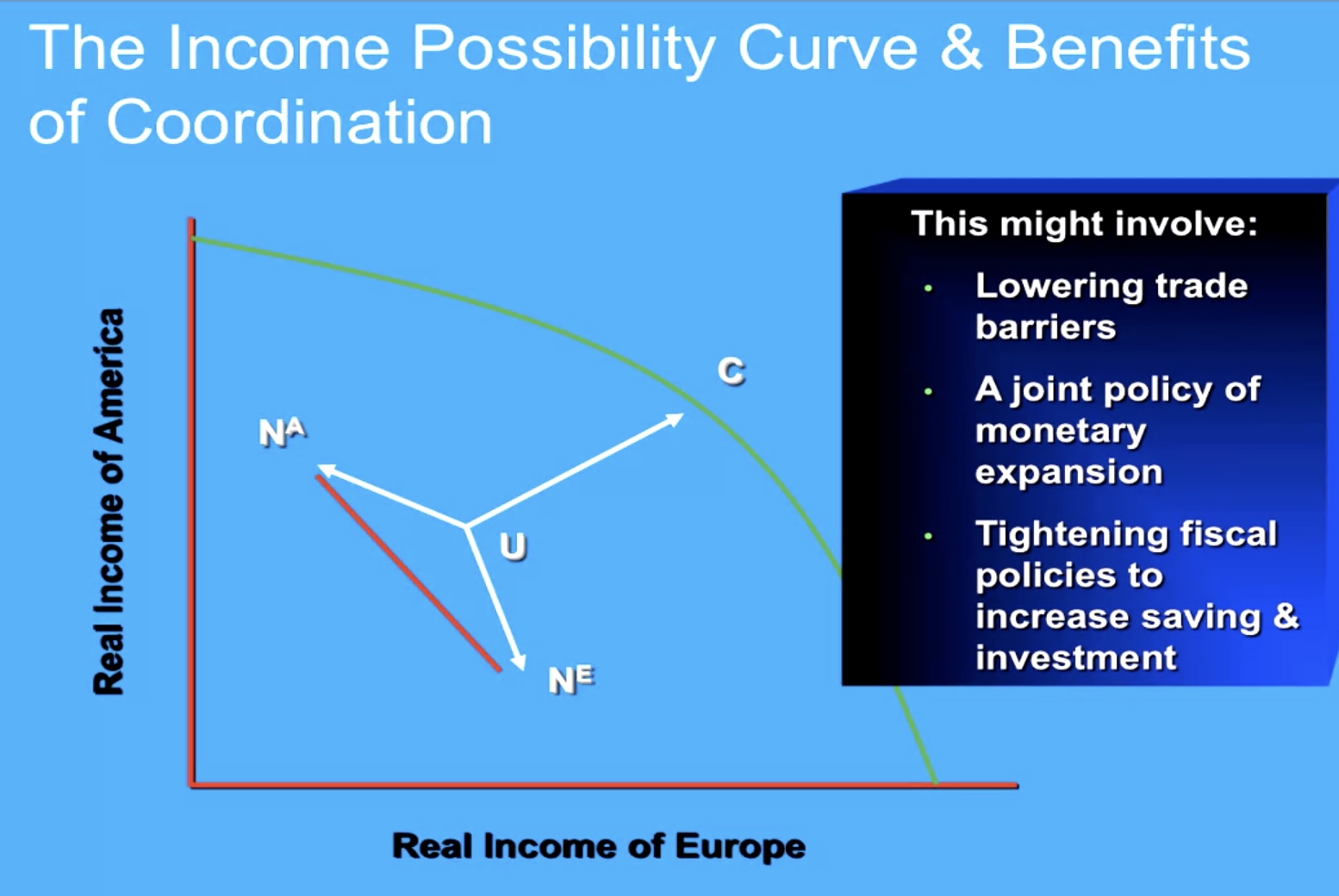

Illustrate the benefits of global coordination.

Some Balance of Payments Accounting

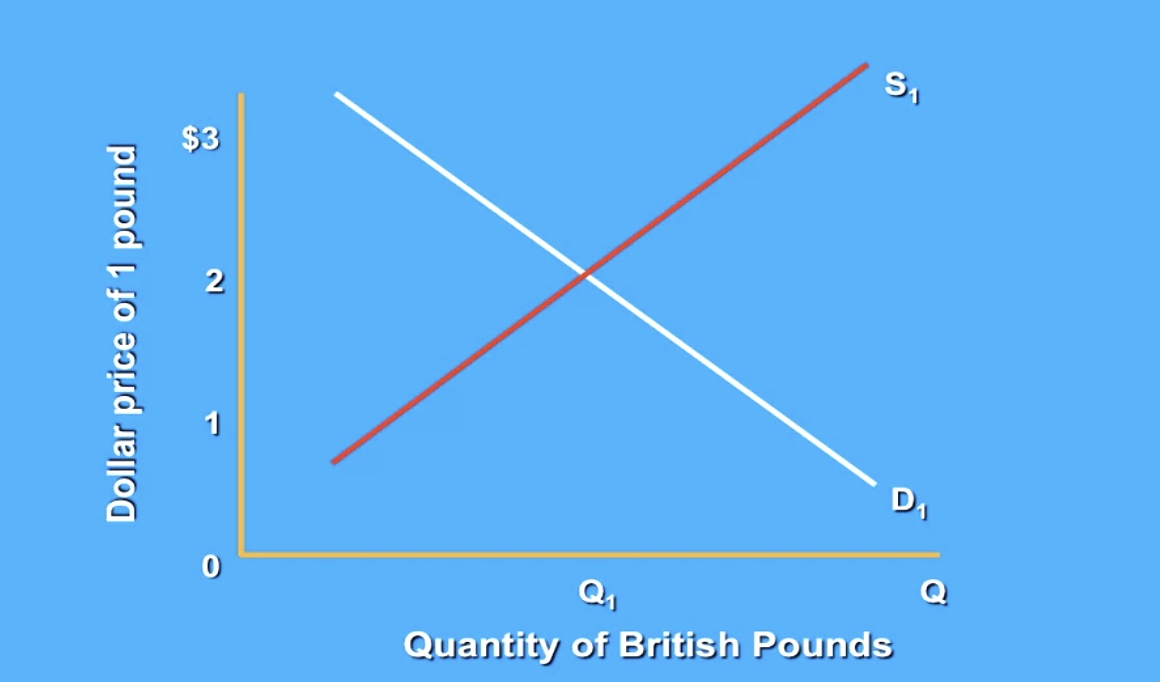

Exchange Rates and why they move

Income Changes -> Demand for foreign products change -> exchange rate change.

Floating Versus Fixed Exchange Rates

Hume’s Gold Specie Flow Adjustment Mechanism

How Chronic Trade Deficits Can Persist

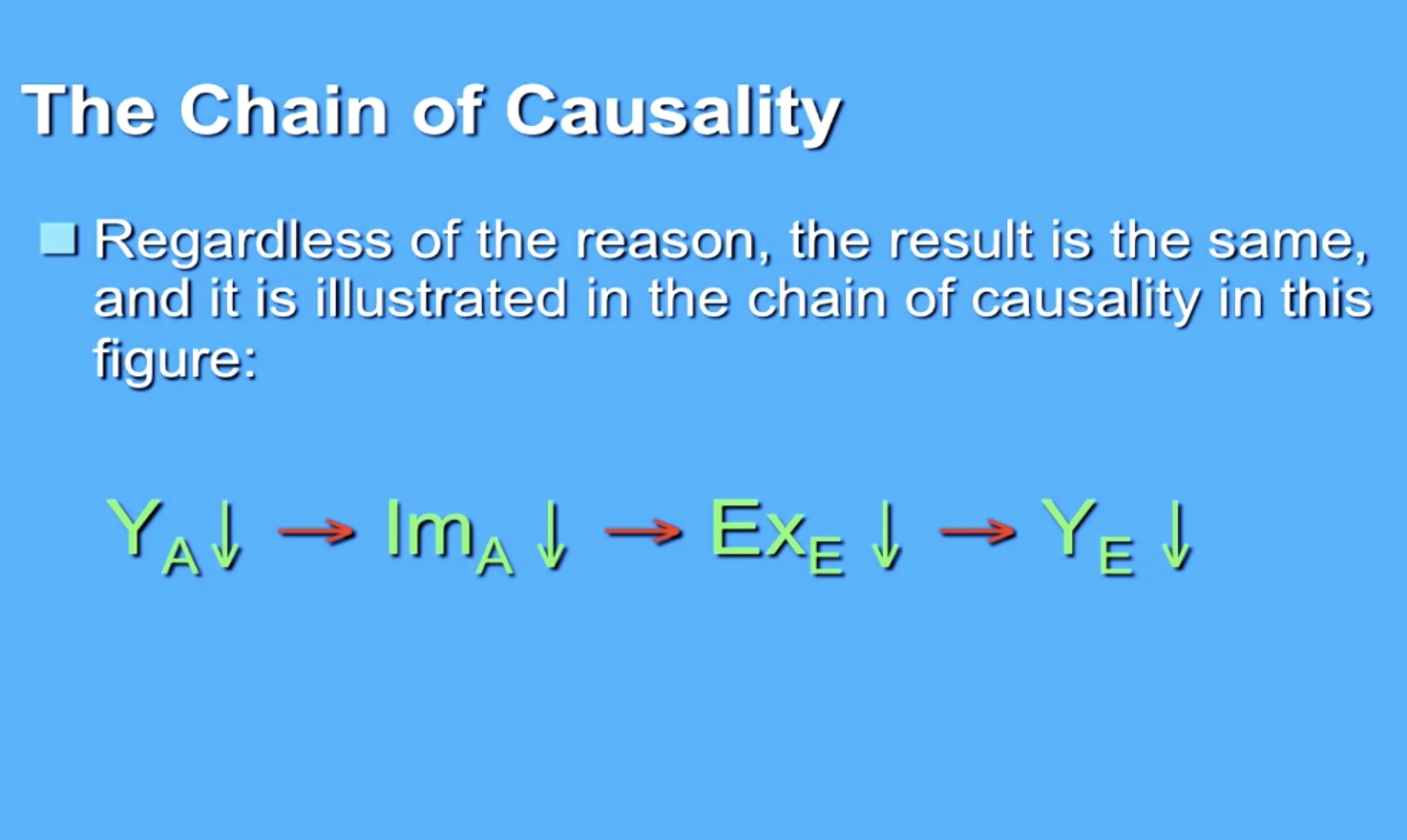

$Y_A $ = Income in America. $Ex_E $= Export in Europe.

First line: Current account effect in the long run Second Line: Capital account effect in the short run

Now let’s look at the impact of domestic monetary policy on the global economy. Specifically, let’s consider what happens in Europe when America raises its interest rates through contractionary monetary policy. This is illustrated in this figure. As America’s interest rate, rA, rises, investors sell European financial assets and buy American financial assets. This leads to an appreciation of the dollar, eS, and a depreciation of European currencies. This in turn increases Europe’s net exports, EXE, and thereby raises European output and income, YE.

Play video starting at :5:56 and follow transcript5:56 Note however, there is an important offsetting effect. In particular, higher interest rates in America tend to raise European interest rates, rE. These higher rates tend to depress domestic investment in Europe, IE, and thereby lower Europe’s output, YE, and employment. Play video starting at :6:17 and follow transcript6:17 In other words, in its attempt to fight domestic inflation, the Federal Reserves of the United States has increased the chance that Europe will experience a recession.

Germany as a Case Study

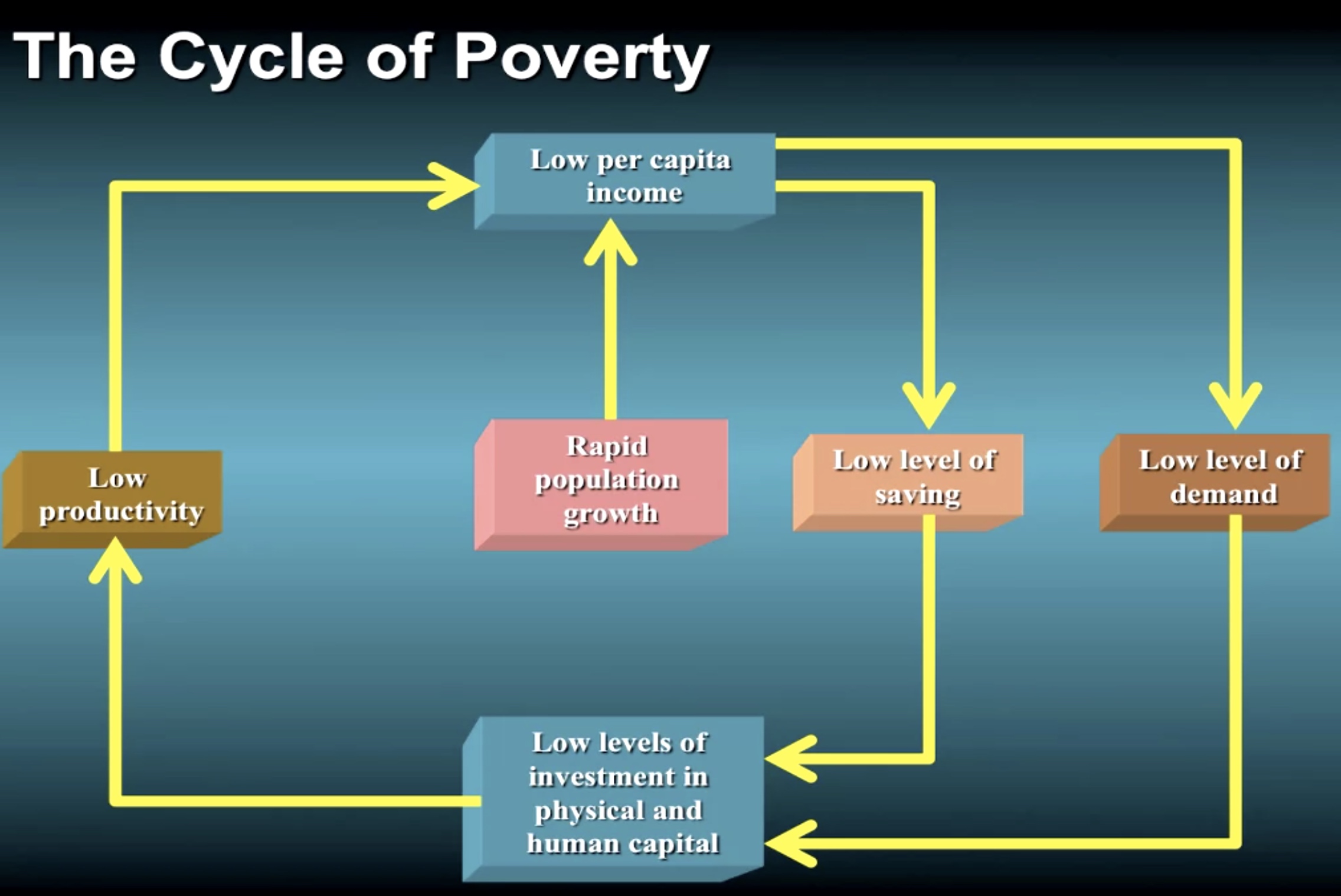

The Economics of Developing Countries

The poorer, developing countries of the world are home to 3/4ths of the world’s population; and of the 5 billion people on this planet, perhaps 1 billion live in absolute poverty barely able to survive from day to day. The central questions we want to try and answer in this module are: What causes the great differences in the wealth of nations? Can the world peacefully survive with poverty in the midst of plenty? What steps can poorer nations take to improve their living standards?

These questions are among the greatest challenges facing modern economics; and we shall see in this module that the tools of macroeconomics, particularly economic growth theory, can make a very big difference in people’s daily lives.

We begin by describing the characteristics of developing countries and reviewing some of the key ingredients in the process of economic development. We then turn directly to the question of why some countries succeed at development while others fail.

In exploring this question, we will examine the debate over different development strategies, from relying upon an industrialized versus agricultural economy and a state run versus market-oriented economy to an economy that is open or closed to global trade. We will also provide the consensus view of the best development strategies and comment on the most constructive role of the industrialized nations in this process.

Comments