Definitions

- Volatility is constant, which is estimated based on historical data.

- Drift $\theta_t$ is deterministic in the sense that it is not a random variable, but a pure already known function of t.

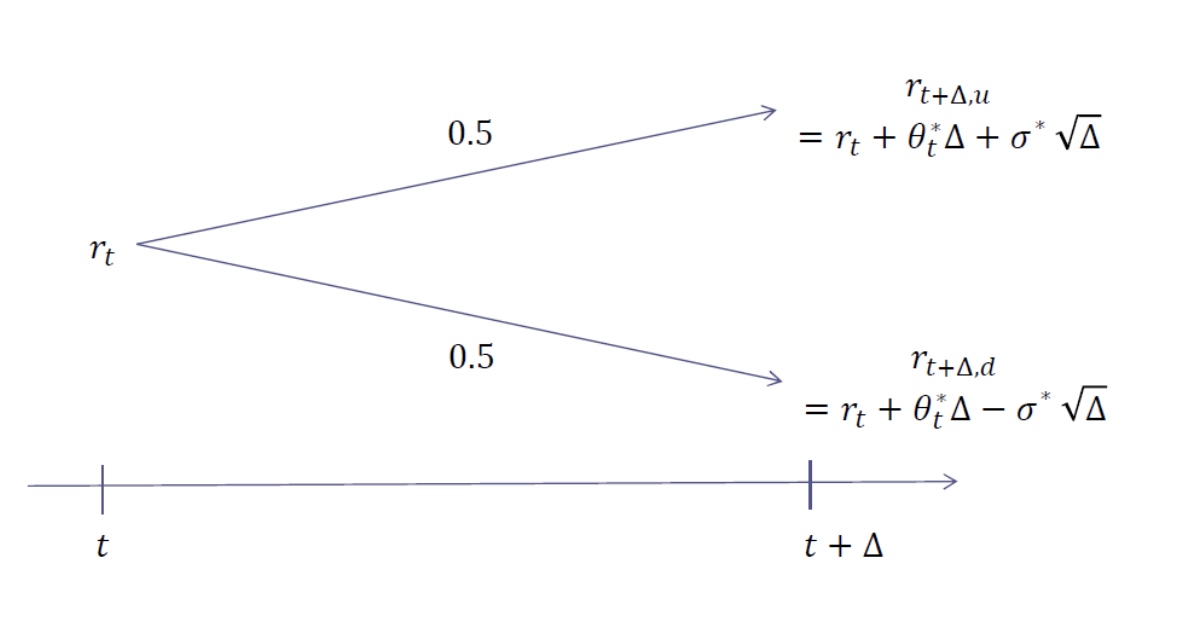

Graphical illustration of a single step:

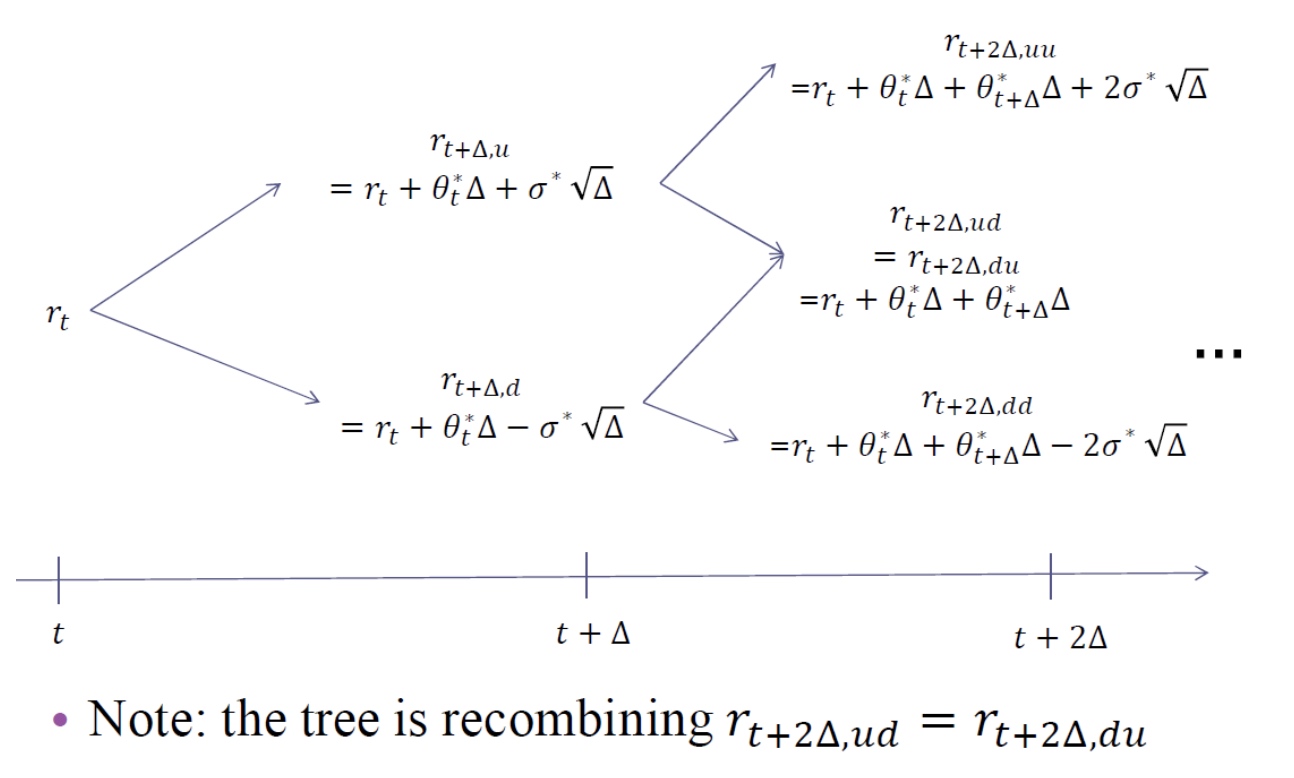

Graphical illustration of two steps:

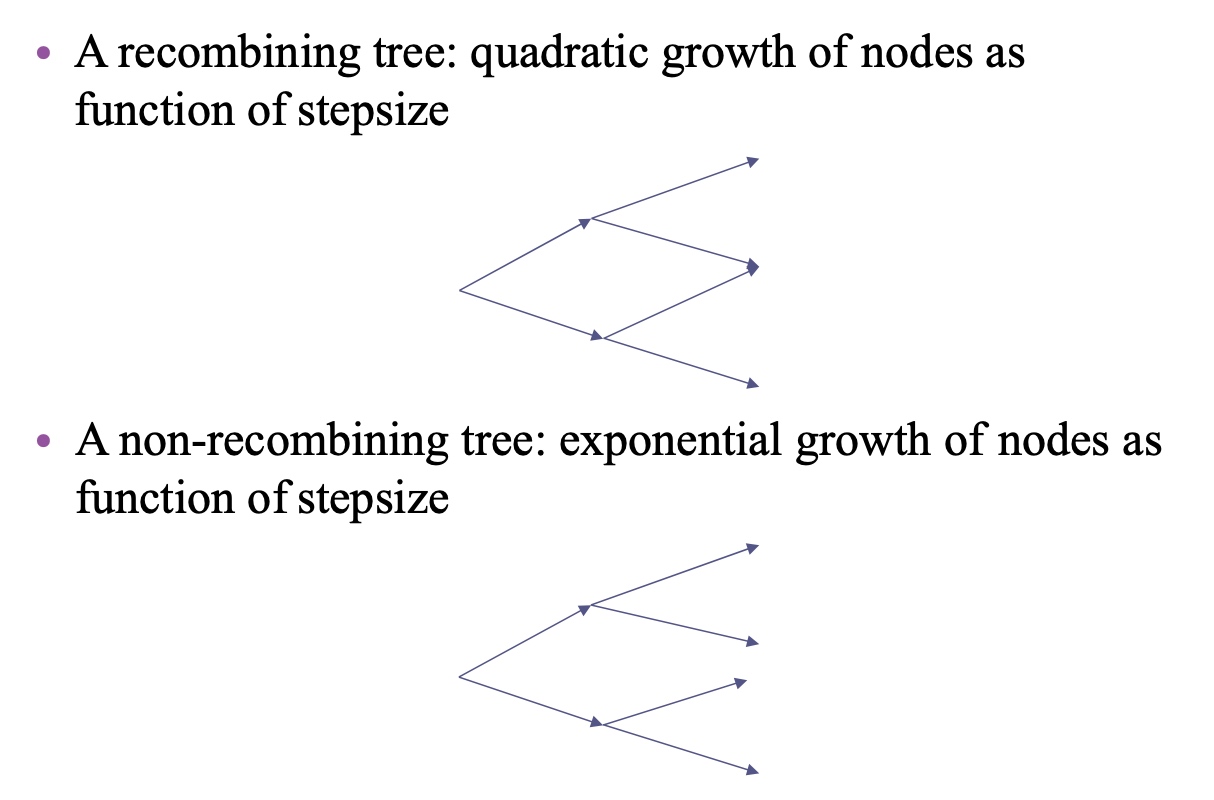

Recombining trees offer numerical tractability

With a fitted Ho-Lee model tree, by risk-neutral pricing:

\[V_0=E_0^Q[\sum_i e^{-(r_o*\Delta+...+r_{i-1}\Delta)} CF_i]\]How to fit the Ho-Lee model

- Start by setting the volatility $\sigma_*$ for interest rate changes.

- This can be estimated from historical data

- Even though we are pricing in the risk-neutral world, the sigma is the same with the physical world.

- Need to pick initial short rate (i.e. $r_0$)

- And One drift parameter (i.e. $\theta^t_*$) for each step

- Pick these parameters so that model implied discount factors agrees with observed discount factors

- Fit the initial term structure in the market.

Assume we already know $r_0$ from observation of $ZCB(0,T_1)$, we price the RN price of $ZCB(0,T_2)$:

\[\begin{aligned} ZCB(0,T_2)&=e^{-r_0 \Delta}E_0^Q(ZCB(T_1,T_2)\\ &=e^{-r_0 \Delta}*(0.5*e^{-r_u \Delta}*1+0.5*e^{-r_d \Delta}*1) \end{aligned}\]Notice that:

\[\begin{aligned} r_{1,u} &=r_0+\theta_0 \Delta + \sigma \sqrt{\Delta}\\ r_{1,d} &=r_0+\theta_0 \Delta - \sigma \sqrt{\Delta}\\ &=r_{1,u}-2 \sigma \sqrt{\Delta} \end{aligned}\]We can fit the $\theta_0$ with $ZCB(0,T_2)$.

Similarly, we can fit the $\theta_1$ with $ZCB(0,T_3)$.

Codes

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

171

172

173

174

175

176

177

178

179

180

181

182

183

184

185

186

187

188

189

190

191

192

193

194

195

196

197

198

199

200

201

202

203

204

205

206

207

208

209

210

211

212

213

214

215

216

217

"""

Ho Lee Binomial model for Interest Rates

Created by Chen Yangyifan 2021.02.28

"""

class HoLee():

# HoLee Model for pring fixed income products

# P:=[P_1,P_2,...P_T]

# P_i is the the price of zero Coupon Bonds matured in i periods

# Notional Amount is 1

# sigma is the annualized std of short rates in decimals (!!not percentage).

# delta is the time step for each period, e.g. 0.25 year

#########################################################################

#

# Node 0 Node 1 Node 2 Node 3 Node 4 Node 5

#

# 0.066643

# 0.0632758

# 0.0616506 0.0616437

# 0.056084 0.0582758

# 0.05263 0.0566506 0.0566437

#0.04969 0.051084 0.0532758

# 0.04763 0.0516506 0.0516437

# 0.046084 0.0482758

# 0.0466506 0.0466437

# 0.0432758

# 0.04164375

#

##########################################################################

def __init__(self):

import numpy as np

import pandas as pd

self.P_zcb=np.nan

self.sigma=np.nan

self.delta=np.nan

# The risk-neutral Prices Tree

self.prices_tree=np.nan

# The risk-neutral Interest Rates Tree

self.rates_tree=np.nan

self.thetas=np.nan

self.compounding=np.nan

def fit(self,P_zcb,sigma,delta,compounding=0):

# if compounding=0 ,Continuously Compounding

# if compounding=1, compounding 1/delta times a year.

from scipy.optimize import fsolve

import numpy as np

import pandas as pd

thetas=[]

P=list(P_zcb)

if compounding ==0:

r0=np.log(P[0])/(-delta)

else:

r0=(1/P[0]-1)/delta

for i,price in enumerate(P[1:]):

p0=price

func=(lambda t: self.myholee(r0,sigma,delta,thetas+[t],compounding)[0]-p0)

new_theta=fsolve(func,0.02)

thetas.append(new_theta[0])

self.P_zcb=P_zcb

self.sigma=sigma

self.delta=delta

self.thetas=thetas

self.compounding=compounding

self.rates_tree=self.myholee(r0,sigma,delta,thetas,compounding)[2]

self.prices_tree=self.myholee(r0,sigma,delta,thetas,compounding)[1]

return

def summary(self):

print("Fitted Interest Rates Tree:")

print(self.rates_tree)

print("============================")

print("Fitted Prices Tree:")

print(self.prices_tree)

def pricing(self,CFs,type='conditional',defer=1):

import numpy as np

import pandas as pd

def discount(rr,TT):

if self.compounding==0:

return np.exp(-rr*TT)

else:

return 1/(1+rr*self.delta)**(TT/self.delta)

# type: fixed, CFs are fixed, and given as a array [CFS_1,CF_2,...,CF_T]

# type: conditional, CFs are contingent on j,r, and given as a function CFs(j,r)

# defer=0, the contingent CF is paid instantly after the amount is decided

# defer=1, means the contingent CF is paid 1 peirod after the amount is decided.

if type=="fixed":

assert len(CFs)==len(self.P_zcb), "Length of CFs are not equal to Length of Given Zero Coupon Bonds"

prices=np.zeros(self.prices_tree.shape)

layers=prices.shape[1]

for j in np.arange(layers-2,-1,-1):

for i in np.arange(j+1):

r=self.rates_tree.iloc[i,j]

prices[i,j]=discount(r,self.delta)*0.5*(prices[i,j+1]+prices[i+1,j+1])+discount(r,self.delta)*CFs[j]

else:

from inspect import isfunction

assert isfunction(CFs), "For Non-Fixed payoffs, CFs must be a function!"

prices=np.zeros(self.prices_tree.shape)

layers=prices.shape[1]

for j in np.arange(layers-2,-1,-1):

for i in np.arange(j+1):

r=self.rates_tree.iloc[i,j]

# Pay instantly

if defer==0:

prices[i,j]=discount(r,self.delta)*0.5*(prices[i,j+1]+prices[i+1,j+1])+CFs(j,r)

# Pay 1 period after the r is realized

elif defer==1:

prices[i,j]=discount(r,self.delta)*0.5*(prices[i,j+1]+CFs(j,r)+prices[i+1,j+1]+CFs(j,r))

else:

print("defer must be 0 or 1!")

raise Error

return [prices[0,0],pd.DataFrame(prices)]

@staticmethod

def myholee(r0,sigma,delta,thetas,compounding=0):

import numpy as np

import pandas as pd

# r0 is the inital short rate

# thetas are theta_0 to theta_T

# delta is the time step

# m is theta_(T+1)

# compounding: 0: continuously compounding

# compounding: 1: 1/delta times a year

# return P[0,0],Prices, Risk_Neutral_Prices

layers=len(thetas)+1

Prices=np.zeros((layers+1,layers+1))

Prices[:,-1]=np.ones(layers+1)

InterestRates=np.zeros((layers,layers))

def discount(rr,TT):

if compounding==0:

return np.exp(-rr*TT)

else:

return 1/(1+rr*delta)**(TT/delta)

# thetas=thetas+[m]

for j in np.arange(layers-1,-1,-1):

for i in np.arange(j+1):

kk=(j-2*i)*sigma*np.sqrt(delta)

r=r0+np.sum([theta*delta for theta in thetas[:j]])+kk

InterestRates[i,j]=r

Prices[i,j]=0.5*(discount(r,delta)*Prices[i,j+1]+discount(r,delta)*Prices[i+1,j+1])

import pandas as pd

return Prices[0,0],pd.DataFrame(Prices),pd.DataFrame(InterestRates)

if __name__ == "__main__":

hl1 = HoLee()

hl1.summary()

a1 = 1 / (1 + 0.04969 * 0.25) ** 1

a2 = 1 / (1 + 0.04991 * 0.25) ** 2

a3 = 1 / (1 + 0.05030 * 0.25) ** 3

a4 = 1 / (1 + 0.05126 * 0.25) ** 4

a5 = 1 / (1 + 0.05166 * 0.25) ** 5

a6 = 1 / (1 + 0.05207 * 0.25) ** 6

P = [a1, a2, a3, a4, a5, a6]

hl1.fit(P, sigma=0.005, delta=0.25, compounding=1)

hl1.summary()

# Fixed CFs

import numpy as np

CF=2*np.ones(len(P))

print(hl1.pricing(CF,type='fixed')[1])# Price Tree

print(hl1.pricing(CF,type='fixed')[0]) # P_0

print(2*np.sum(P))

# Contigent CFs

hl2=HoLee()

pzcb=[99.1338,97.8925,96.1462,94.1011,91.7136,89.2258,86.8142,84.5016,82.1848,79.7718,77.4339]

pzcb=[item/100 for item in pzcb]

hl2.fit(pzcb,0.0173,0.5)

def mycf(j,r):

# only pays depends on r_10

# max(11*100*r,94)

if j==10:

return max(11*100*r,94)

else:

return 0

mycf(10,0.18856)

p0=hl2.pricing(mycf,type='conditional',defer=0)[0]

print(p0)

price_tree=hl2.pricing(mycf,type='conditional',defer=0)[1]

print(price_tree)

Comments